Among the top of their class: ETFs actively managed by artificial intelligence outperformed the majority of peers in 2022

While many investors were delighted to say goodbye to 2022, most were also ready to say good riddance. The year started on a bright note, with the S&P 500 reaching an all-time high on January 4, 2022…but it was downhill from there. In February, Russia invaded Ukraine. In March the US Federal Reserve began hiking rates, raising its benchmark from a range of 0%-0.25% at the start of 2022 to 4.25%-4.50% by year end. Meanwhile, supply disruptions contributed to skyrocketing energy prices, and in June inflation hit a 40-year high.

Heightened emotions and fast-moving markets provide an excellent backdrop for artificial intelligence (AI) models to excel as they provide clear direction and action in real-time. AI extends skilled human investment capabilities, but without human emotion, creating the foundation for investment solutions designed to withstand volatile markets and outperform over market cycles.

It is on this premise that Qraft, a fin-tech headquartered in South Korea, created three active ETFs listed on the NYSE: Qraft AI-Enhanced U.S. Large Cap ETF (QRFT), Qraft AI-Enhanced U.S. Large Cap Momentum ETF (AMOM), and Qraft AI-Enhanced U.S. Next Value ETF (ticker NVQ).

Qraft’s AI-driven investment process operates free of emotion, absorbing, analyzing, and processing a vast amount of market and security level data to identify high conviction names suitable for inclusion in the portfolio. Qraft’s AI models are designed to replicate what a typical human active fund manager would consider in selecting stocks and constructing a portfolio, with AI assessing the macro environment and making connections with individual stocks that have the potential to outperform given the patterns and signals the models detect in the current regime. Each strategy has specific parameters, defined and supervised by Qraft’s investment experts, to help ensure risk controls as we pursue alpha generation over the long term.

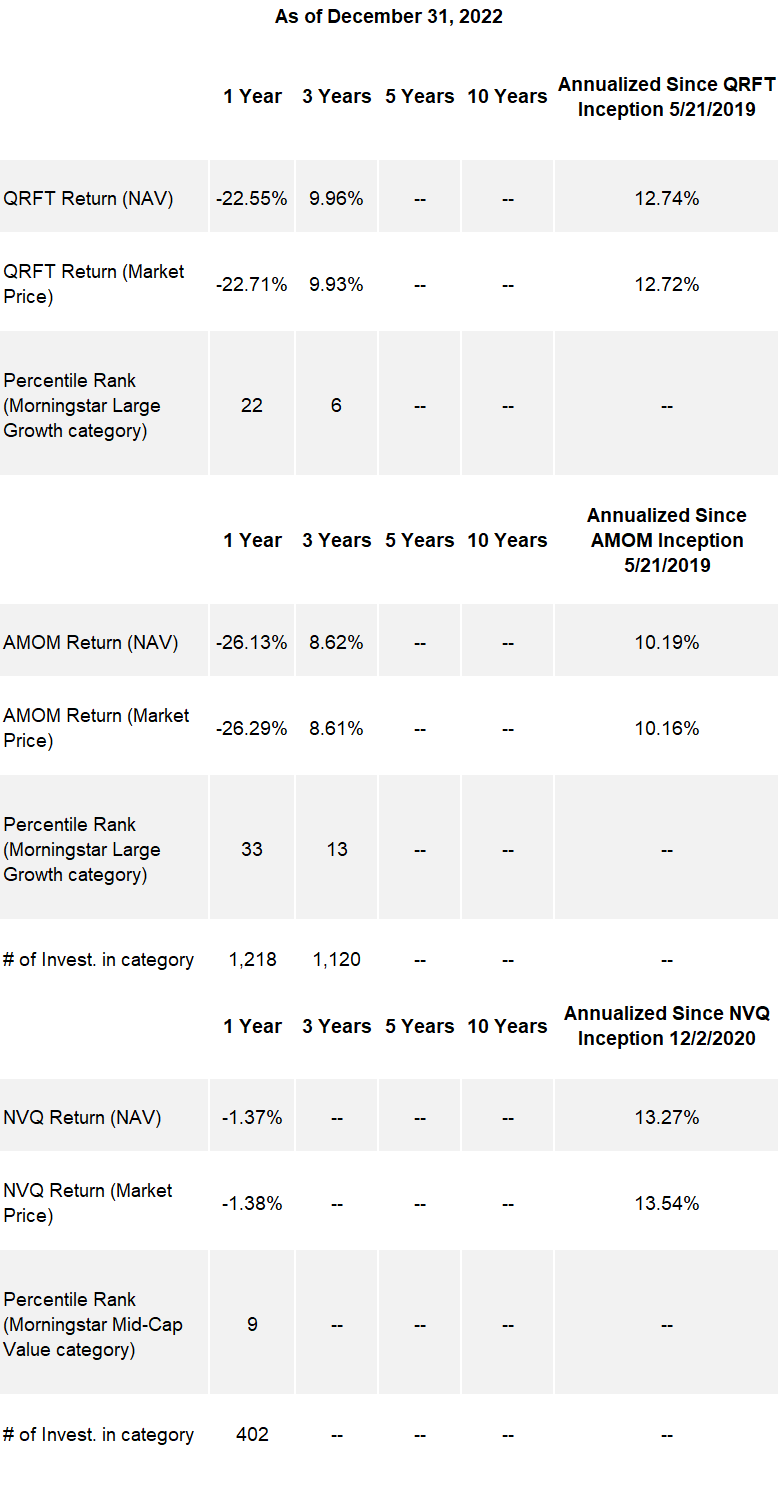

While on an absolute basis, Qraft’s active ETFs experienced negative absolute returns over 2022, relative to peer managers, the strategies were near the top of their peer group. Notably, NVQ outperformed over 90% of peer strategies and QRFT outperformed over 80% of peer strategies. AMOM also had a solid showing, outperforming over 65% of peer strategies.

Over the three-year period, QRFT and AMOM had similarly strong results, and had positive absolute returns. QRFT ranked in the top 6% of the Morningstar Large Growth peer group and AMOM ranked in the top 9% among over 1,200 peer strategies. NVQ, launched in 2020, will not mark its three-year anniversary until later this year.

With their competitive performance amid the turmoil of 2022 and their compelling longer-term track records, we are eager to see how the Qraft AI-Enhanced ETFs perform in 2023. For more information on Qraft Technologies and the use of artificial intelligence in the investment process, please visit https://qraftaietf.com/.

Total Annual Expense Ratio (gross of any fee waivers or expense reimbursements):

QRFT: .75% AMOM: .75% NVQ: .75%

Source: www.qraftaietf.com. Performance data quoted represents past performance and is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the original cost. Returns for periods of less than one year are not annualized. For the most recent month-end returns visit www.qraftaietf.com.

Morningstar rankings are based on a fund's average annual total return relative to all funds in the same Morningstar category. Fund performance used within the rankings reflects certain fee waivers, without which, returns and Morningstar rankings would have been lower. The highest (or most favorable) percentile rank is 1 and the lowest (or least favorable) percentile rank is 100.

Market Price: The current price at which shares are bought and sold. Market returns are based upon the last trade price.

NAV: The dollar value of a single share, based on the value of the underlying assets of the fund minus its liabilities, divided by the number of shares outstanding. Calculated at the end of each business day.

Important Information

Investing involves risk including possible loss of principal. Diversification does not ensure profits or prevent losses.

Artificial intelligence selection models are reliant upon data and information supplied by third parties that are utilized by such models. To the extent the models do not perform as designed or as intended, the strategy may not be successfully implemented. If the model or data are incorrect or incomplete, any decisions made in reliance thereon may lead to the inclusion or exclusion of securities that would have been excluded or included had the model or data been correct and complete. Service providers may experience disruptions that arise from human error, processing and communications error, counterparty or third-party errors, technology or systems failures, any of which may have an adverse impact. While it is anticipated the Adviser, Exchange Traded Concepts LLC, will purchase and sell securities based on recommendations of QRAFT AI, the Adviser has full discretion over investment decisions for the Fund.

Investors should consider the investment objectives, risks, charges, and expenses carefully before investing. For a prospectus or summary prospectus with this and other information about the Qraft ETFs, please call (855) 973-7880 or visit our website at www.qraftaietf.com. Read the prospectus or summary prospectus carefully before investing.

Distributed by Foreside Fund Services, LLC

Investing involves risk, including loss of principal. The Funds are subject to numerous risks including but not limited to: Equity Risk, Sector Risk, Large Cap Risk, Management Risk, and Trading Risk. The Funds rely heavily on a proprietary artificial intelligence selection model as well as data and information supplied by third parties that are utilized by such model. To the extent the model does not perform as designed or as intended, the Fund’s strategy may not be successfully implemented, and the Funds may lose value. Additionally, the funds are non-diversified, which means that they may invest more of their assets in the securities of a single issuer or a smaller number of issuers than if they were a diversified fund. As a result, each Fund may be more exposed to the risks associated with and developments affecting an individual issuer or a smaller number of issuers than a fund that invests more widely. A new or smaller fund’s performance may not represent how the fund is expected to or may perform in the long term if and when it becomes larger and has fully implemented its investment strategies. Read the prospectus for additional details regarding risks.