Two Things to Look Out for If You Are Moving to Value Investing in 2022

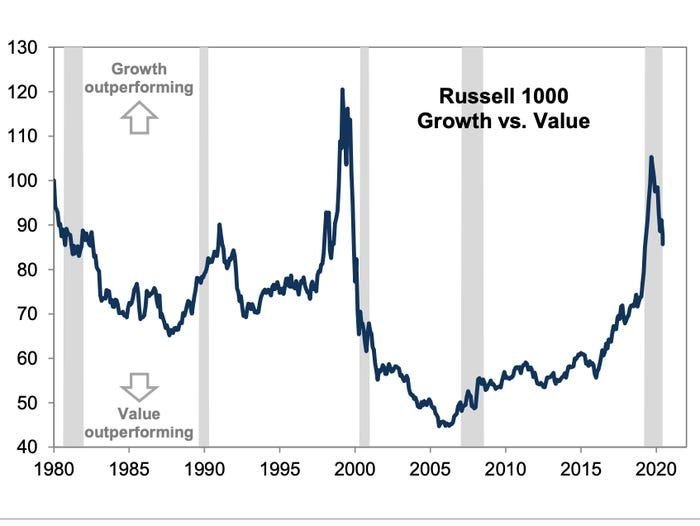

The start of 2022 has been full of uncertainty to investors with trends in rising 10-year US Treasury yield and high inflation fueling market expectation on interest rate hikes. During the past 10 years, with the decline in 10-year US Treasury yield, which is typically used as the discount rate for future earnings, growth investing[1] has been outperforming value investing.[2] This is visible through observing big tech companies such as Apple, Microsoft, Alphabet, and several others which experienced exponential growth dominating top positions within the S&P 500 index.[3]

However, with the severity of the Omicron variant being less than expected, around the world there has been increased efforts by central banks to normalize their economy resulting in the highest inflation level in 40 years.[4] Reacting to the persistently high inflation [5], the U.S. Federal Reserve (FED) is planning to tighten the monetary policy at a much faster pace than expected a year ago, meaning a hike in interest rates [6].

This is where value investing comes in. According to Schroders [7], when observing the average return data of growth and value stocks from 1982 to 2021, value typically outperforms in periods of sharp and sudden real yield increases which are affected by the rise in interest rates. With the market expecting the FED to raise interest rates sooner than anticipated and investors expecting three more interest rate hikes in the first three quarters of 2023, there is a potential for value to outperform growth.

The trend of outperforming value investment is also evident in the Russell 1000 Growth Index lagging the Russell 1000 Value Index by 20 percentage points since November 2020.

Aware of these market trends, here are two things to consider for those transitioning to value for the first time or the first time in a while.

1. Value investing tends to outperform over the long term

Looking at historical data value investing has performed better in the long term. According to BlackRock, value has an annualized return of 13% between 1926 to 2020 while growth has an annualized return of 10%.[9] Although the recent outperformance of value investing has been short-lived and may be short-lived even with the increasing interest rate and high inflation, historically it has been a good investment in the long-term. Warren Buffet one of the most renowned value investors over the years has been, successfully created his own value investing strategy through his investment vehicle Berkshire Hathaway Inc. However, past success does not equal future success, and many argue that value investing metrics potentially need to be adjusted to continue the long-term success.

2. Changing value metrics

In the past where businesses conducted with tangible assets [10], such as factories, price-to-value ratios, and price-to-earnings ratios were the commonly used performance indicators to base their valuation on a company. Now with the rapid adoption of technology, intangible assets[11] such as brand, patents, and intellectual property are becoming more important measures to include in valuation making traditional ratios obsolete. [12]

An accurate valuation of a company is a critical indicator for the value investor in making investment decisions. With “asset-light” becoming a positive feature for modern businesses, it is essential to reflect this shift in asset components in the valuation of a company.

About NVQ

To embrace for these changes, Qraft AI-Enhanced U.S. Next Value ETF(NVQ) can potentially be an alternative option for investors both concerned about rising rates and considering taking their first step in transitioning into value investing. NVQ is an actively managed AI ETF that measures intangible assets such as R&D costs, marketing costs, patent issuance, etc in the hopes to find the correct value metrics in value investing. Utilizing AI, NVQ provides a comparatively new approach to value investing by processing large amounts of data at a lower cost to accurately gauge if a company is undervalued in relation to the fundamentals.

Observing the total return of NVQ, it has been exceeding the total return of S&P Value Index showing attractive performances since December 3rd 2020.

Rebased at 100

Source: Company data, S&P Compustat Total Return

Data available as of Jan 21, 2022

Over the last few years, growth investing has been the major focus for many investors. Now with rising interest rates accelerated by high inflation many are shifting their focus to value investing. Therefore, investors should be mindful of changing value metrics and the long-term outlook when transitioning into value investing.

[1] Growth Investing - Growth investing is an investment style and strategy that is focused on increasing an investor's capital. Growth investors typically invest in growth stocks—that is, young or small companies whose earnings are expected to increase at an above-average rate compared to their industry sector or the overall market.

[2] Value Investing - Value investing is an investment strategy that involves picking stocks that appear to be trading for less than their intrinsic or book value.

[3] Times of Malta. (2022, January 20). The value vs growth debate − Edward Rizzo. Retrieved January 26, 2022, from https://timesofmalta.com/articles/view/the-value-vs-growth-debate-edward-rizzo.928957

[4] Ghosh, I., & Bhat, P. (2022, January 20). Fed to raise rates three times this year to tame unruly inflation: Reuters poll. Reuters. Retrieved January 26, 2022, from https://www.reuters.com/business/fed-raise-rates-three-times-this-year-tame-unruly-inflation-2022-01-20

[5] Inflation - Inflation is the rate at which the value of a currency is falling and, consequently, the general level of prices for goods and services is rising.

[6] Interest rate - Interest rate is the amount charged on top of the principal by a lender to a borrower for the use of assets.

[7] Sean Markowicz. (2021, April 21). What really drives rotations from growth to value stocks? Schroders. Retrieved February 4, 2022, from https://www.schroders.com/en/au/institutions/insights/investment-insights/what-really-drives-rotations-from-growth-to-value-stocks/

[8] Goldman Sachs says value stocks will outperform in the near term – but growth stocks will take the lead by end of 2021. (2021, June 13). Market Insider. Retrieved January 26, 2022, from https://markets.businessinsider.com/news/stocks/stock-market-outlook-goldman-sachs-value-versus-growth-stocks-inflation-2021-6-1030517917

[9] Opportunity still alive in value stocks. (2021, March 31). BlackRock. Retrieved January 26, 2022, from https://www.blackrock.com/us/individual/insights/value-stock-opportunity

[10] Tangible assets - Tangible asset is an asset that has a finite monetary value and usually a physical form. Tangible assets can be recorded on the balance sheet as either current or long-term assets.

[11] Intangible assets - Intangible asset is an asset that is not physical in nature, such as a patent, brand, trademark, or copyright. Intangible assets created by a company do not appear on the balance sheet and have no recorded book value.

[12] BSCI. (2020, December 6). Value Factor in the intangible Economy. BSIC | Bocconi Students Investment Club. Retrieved January 26, 2022, from https://bsic.it/value-factor-in-the-intangible-economy/.

[13] Ali, A. (2021, February 16). The Soaring Value of Intangible Assets in the S&P 500. Visual Capitalist. Retrieved January 26, 2022, from https://www.visualcapitalist.com/the-soaring-value-of-intangible-assets-in-the-sp-500/.