Resilient Gains Amid Volatile Skies: LQAI Portfolio Performance & Rebalancing Review

To download a PDF version of this report, click here

Performance Overview

The LQAI portfolio achieved a robust monthly return of approximately 6.22%, outperforming the volatile S&P 500 during a period characterized by geopolitical tensions, trade uncertainty, and rising oil prices from Middle East conflicts. Strong returns were primarily driven by exposure to Information Technology, Communication Services, and Consumer Discretionary sectors, benefiting from resilient investor optimism, solid earnings from major companies such as Nvidia, Microsoft, Alphabet, and Meta, and steady consumer spending supported by continued labor market strength.

Amid broader economic headwinds—weakening retail sales, cautious consumer sentiment, and inflationary pressures from tariffs and higher energy costs—the portfolio’s strategic sector allocation effectively balanced growth opportunities with prudent risk management. Considering increased market volatility and policy uncertainties, a cautious and defensive approach was adopted, emphasizing stable sectors to protect portfolio value.

Monthly Review

Between June 9 and July 6, 2025, U.S. markets faced heightened economic uncertainty, notably due to escalating geopolitical tensions and rising oil prices approaching $80 per barrel, spurring inflation concerns. Although the Federal Reserve maintained rates at 4.25%–4.50%, potential future rate adjustments remain contingent on inflation developments. Employment growth remained healthy, with 147,000 jobs added and stable unemployment at 4.1%, supporting record highs in major indices. Nonetheless, retail sales fell by 0.9%, personal incomes were subdued, and consumer sentiment weakened.

Looking ahead, moderate U.S. economic growth is anticipated, accompanied by continued volatility driven by geopolitical risks, trade uncertainties, and mixed economic signals. Investors will closely watch Federal Reserve actions, GDP and CPI data, and trade policy developments, which will likely influence market volatility significantly.

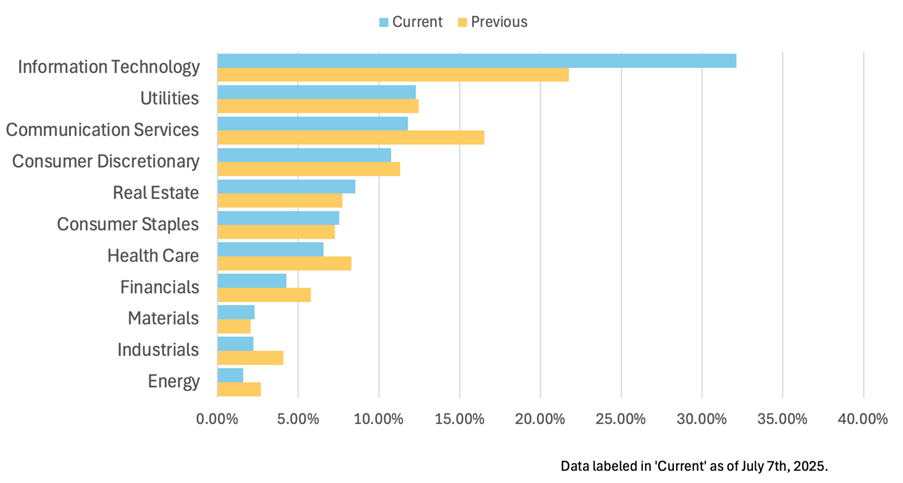

Reflecting this cautious outlook, the portfolio was strategically repositioned towards defensive sectors: Utilities (increased from 4.71% to 10.49%), Real Estate (from 5.76% to 8.53%), and Consumer Staples, offering stability amid uncertainty. Increased Utilities allocation provides earnings reliability, while Real Estate could benefit from interest rate stability. Additionally, the portfolio selectively raised Information Technology exposure (now 32.13%), targeting high-growth firms like Nvidia, Alphabet, Tesla, and Meta, benefiting from potential easing monetary conditions. Conversely, exposure to Financials, Energy, and Materials was reduced due to their heightened sensitivity to economic volatility and geopolitical factors. This repositioning aims to capture growth opportunities while effectively managing downside risks.

Portfolio Overview

Top Holdings – NVDA

NVIDIA Corporation (NVDA) is navigating a transformative period amid evolving geopolitical dynamics, regulatory pressures, and substantial technological advancements, prompting an increased portfolio allocation to 7.04%, signifying strong confidence in the company's strategic growth potential. NVIDIA's technological leadership is evident through significant expansions in AI infrastructure, supercomputing capabilities across Europe, strategic partnerships with Hewlett Packard Enterprise and the Leibniz Supercomputing Centre, and pioneering initiatives such as its 'Climate in a Bottle' AI model. Despite short-term impacts from new U.S. export controls reducing its exposure to the Chinese market, NVIDIA's proactive diversification strategy, demonstrated by its participation in global forums and reduced dependency on China, ensures resilience against geopolitical uncertainties and positions the company to achieve stable, diversified growth. Elevated analyst ratings and strengthened investor sentiment, particularly following Barclays' upgraded forecast driven by expectations around NVIDIA’s advanced Blackwell Ultra chips, reinforce positive market sentiment and confidence in the firm's growth trajectory, underpinning NVIDIA's elevated role within the rebalanced LQAI portfolio.

Top Holdings – GOOGL

Alphabet Inc. (GOOGL) currently benefits from strengthened market positioning through strategic collaborations, notably a transformative partnership with OpenAI, which enhances Alphabet's competitive edge in cloud computing and the fast-growing AI market, affirming it among our top-three holdings in the rebalanced LQAI portfolio at 4.52%. Despite competition risks to its core search business from advanced AI models like ChatGPT, Alphabet's integration of OpenAI into its Google Cloud infrastructure signals long-term revenue growth potential and improved investor sentiment. Positive regulatory developments, exemplified by Mexico's antitrust authority clearing Alphabet of monopolistic accusations, significantly alleviated risk, underscoring improved regulatory outlook, and reinforced confidence in maintaining substantial investment weighting. Additionally, Alphabet demonstrates robust strategic innovation and long-term growth commitment via expansion of Waymo's autonomous vehicle operations, authorizing services into new markets and significantly increasing fleet utilization. With over 1,500 vehicles in operation and substantial weekly engagement, Waymo represents strong forward-looking revenue potential and effective execution in technologically advanced, regulated industries, reinforcing Alphabet's credibility and solid fundamentals for sustained growth, supporting a continued optimistic outlook for Alphabet Inc., GOOGL.

Top Holdings – TSLA

Tesla, Inc. (TSLA) faces a challenging environment defined by regulatory scrutiny, evolving investor sentiment, and heightened market competition, yet the company's fundamentals remain robust. Reflecting these conditions, Tesla's weighting in the LQAI portfolio has been increased to 4.96%, becoming a top-three holding to strategically leverage potential benefits from the transformative robotaxi service launch in Austin, Texas, which demonstrates leadership in autonomous driving innovation, diversified growth opportunities, and improved investor outlook. Despite short-term regulatory uncertainties stemming from the NHTSA investigation over compliance concerns with autonomous technologies, Tesla's proactive regulatory engagement and consistent safety improvements support a positive long-term fundamental outlook. Although competition from entrants like Xiaomi has pressured Tesla’s market share in key markets, the company's strategic management—including production enhancements at the Berlin plant and battery storage innovations in Shanghai—highlights adaptive capability and competitive resilience, reinforcing confidence in Tesla’s sustained market strength and financial performance over the medium to long term.

Notable Changes – AMD (Upgrades)

The current circumstance at Advanced Micro Devices, Inc. (AMD) is marked by strong positive momentum driven by significant strategic initiatives, transformative product releases such as the MI400 AI chip series and Helios servers, and key acquisitions—including ZT Systems and talent recruitment in AI—highlighting its aggressive positioning to challenge Nvidia's dominance in AI chip technology. Analyst endorsements from influential institutions like Piper Sandler and Melius Research, reflecting increased confidence in AMD's competitive potential and sustainable growth trajectory in GPU and AI sectors, have further enhanced market sentiment and investor outlook. Moreover, improving geopolitical factors, notably the easing of U.S. export controls on chip design software exports to China, positively alleviate previous concerns, expanding AMD's international growth prospects and profitability. Due to these fundamental strengths, positive analyst revisions, and improving global market access, AMD's financial health and strategic alignment support an optimistic yet responsibly managed increase in its portfolio weighting within LQAI, highlighting a strong outlook and prudent diversification approach.

Notable Changes – FE (Upgrades)

FirstEnergy Corp. (FE) currently experiences notably improved market sentiment and analyst optimism, prompting an increased portfolio allocation to 1.74% within the LQAI strategy, though a cautious approach remains due to concerns regarding its financial strategy and recent convertible bond issuance risks. UBS's recent analyst upgrade has enhanced investor confidence, reflecting expectations for potential improvements in FE's operational and financial efficiency. The company's management has proactively addressed liquidity and debt restructuring issues through sizable convertible bond issuance, which, despite raising initial dilution risks, supports FE's longer-term financial stability and creditworthiness. Additionally, favorable industry dynamics, driven by increasing extreme weather and rising electricity demand, position FirstEnergy positively within the regulated utilities sector, reinforcing confidence in its fundamental outlook and supporting its inclusion and elevated weighting in the rebalanced portfolio.

Notable Changes – JPM (Downgrade)

Recent developments have led to a cautious stance on JPMorgan Chase & Co. (JPM), prompting a substantial reduction of its weight in our rebalanced LQAI portfolio from 3.75% down to 0.17%. Despite the company's strong fundamental performance, including passing Federal Reserve stress tests with a robust 14.2% capital ratio, increased geopolitical tensions and deteriorating macroeconomic conditions significantly affect JPM's medium-term outlook. JPM itself estimated a 40% recession probability due to adverse U.S. trade policies, notably impacting market sentiment toward banking stocks, vulnerable to reduced loan growth and elevated defaults. Additionally, recent regulatory uncertainties and increased scrutiny around governance and compliance pose operational and reputational risks. JPM's continued aggressive expansion into fossil fuel financing, which rose 28.1% to $53.5 billion in 2024, further heightens concerns about potential ESG-related impacts and institutional investor response. Together, these factors justify our strategic decision to decrease JPM's portfolio allocation based on careful assessment of its evolving risk profile and impacted financial prospects.

Notable Changes – MSFT (Downgrade)

Over the past month, Microsoft's business circumstances have worsened due to intensified competition in artificial intelligence, regulatory scrutiny, and internal restructuring, leading to a reduction of its stake within our LQAI portfolio from 6.01% down to 3.77%. A major concern is OpenAI's recent shift away from exclusive reliance on Microsoft's Azure platform toward Google's Cloud services, threatening Microsoft's dominance in the AI market. Additionally, growing antitrust allegations related to its partnership with OpenAI pose regulatory risks, potentially leading to costly legal actions and further competitive pressures. Fundamentally, Microsoft is undergoing operational restructuring involving approximately 18,100 layoffs, raising concerns about internal cost pressures in the near term despite potential long-term margin benefits. Furthermore, delays in the development of its internal Maia AI chip, now expected in 2026, weaken Microsoft's competitive stance against Nvidia and Amazon. Given these factors, Microsoft's immediate outlook appears challenging, necessitating a more defensive portfolio positioning to mitigate downside risks amid current uncertainties.

Notable Changes – CAG (Downgrade)

Conagra Brands, Inc. (CAG) currently faces considerable operational and market pressures, reflected in its anticipated fourth-quarter earnings decline due primarily to shifting consumer preferences toward lower-priced private label products and heightened commodity costs, particularly in proteins. Coupled with persistent inflation, these economic headwinds have negatively impacted investor sentiment, amplified by a recent downgrade from Bank of America Global Research citing supply chain disruptions and profitability concerns; only 2 out of 19 analysts maintain a 'buy' rating, indicating widespread skepticism. Although recent strategic decisions by Conagra—involving the removal of synthetic and artificial colors from frozen products and cessation of artificial colors in school-sold products—position the firm positively for future consumer trust and longer-term recovery, the portfolio (LQAI) has significantly reduced exposure to mitigate short- to medium-term risks, reflecting cautious expectations towards Conagra's fundamentals and financial performance amid ongoing challenges.

About Qraft Technologies

Qraft Technologies is a fintech company aiming to drive growth in the asset management industry through its innovations in artificial intelligence (AI) and investing. Qraft offers a variety of AI-powered investment solutions, including a security selection engine, asset allocation engine, robo-advisory solution and an AI order-execution system. From data processing to alpha research and portfolio execution, Qraft has an established track record in developing cutting-edge AI solutions that have been adopted by over 25 financial institutions worldwide. In 2022, Qraft received a US$146 million investment from SoftBank Group, entering into a strategic partnership to accelerate AI in the asset management industry.

About LG AI Research

Launched in December 2020 as the artificial intelligence (AI) research hub of South Korea's LG Group, LG AI Research aims to lead the next epoch of artificial intelligence (AI) to realize a promising future by providing optimal research environments and leveraging state-of-the-art AI technologies. And LG AI Research developed its large-scale AI, EXAONE, a 300 billion parametric multimodal AI model, in 2021. EXAONE, which stands for “Expert AI for Everyone,” is a multi-modal large-scale AI model that stands out from its peers due to its ability to process both language and visual data. With one of the world’s largest learning data capacities, LG AI Research aims to engineer better business decisions through its state-of-the-art artificial intelligence technologies and its continuous effort on fundamental AI research. For more information, visit https://www.lgresearch.ai/.