Barbell in a Storm: Balancing Bank Steel with Silicon Speed

To download a PDF version of this report, click here

The performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than their original cost. Returns for periods of less than one year are not annualized. Performance results, current to the most recent month end may be obtained by visiting Qraft AI ETFs at www.qraftaietf.com/lqai. (As of 09/01/25)

Performance Overview

Over the past month, the portfolio before the rebalancing delivered a 1.70% gain with a

-2.60% max drawdown and a modest Sharpe, reflecting a choppy but ultimately positive tape; this was broadly in line with the S&P 500 (roughly +1%–2%) as markets swung between softer labor data and evolving rate-cut odds. I saw strength from our overweight in AI-led mega-cap tech (NVDA, MSFT, AAPL, AMD) and platform leaders (AMZN, META, GOOGL), which benefited when CPI/PCE¹ stayed contained and Powell’s Jackson Hole remarks boosted risk appetite, culminating in a sharp rebound on August 22. Conversely, the mid-month pullback (notably August 19–21) came as a hotter PPI² print and widening tariff risks (especially the new 25% levy on Indian goods and century-high average U.S. tariffs) raised concerns about sticky services inflation and margin pressures, weighing on high-beta³ growth and selected consumer names. Financials were mixed amid rising jobless claims and rising odds of a September cut, while our smaller exposures to defensives helped steady returns when volatility rose. With this backdrop—cooling job growth, firm core inflation, and tariff pass-through risks—I’ve shifted the portfolio after the rebalancing toward a more balanced stance, adding to Financials and Health Care while trimming exposure to areas more sensitive to headline and input-cost shocks.

Monthly Review

Over the past month, U.S. markets whipsawed as weakening labor data and tariff-driven price pressures pushed the Fed firmly toward a September cut. July payrolls rose just 73,000 with 258,000 in downward revisions, unemployment ticked to 4.20%, and jobless claims climbed to 235,000; August payrolls were expected 75,000 with unemployment 4.30%. Powell’s dovish Jackson Hole tone sent the Dow Jones Industrial Average⁴ to a record 45,631.74 and the S&P 500 up 1.50% as the 10-year yield eased to 4.26% and the dollar softened. But inflation remained sticky—PPI jumped 0.90% MoM⁵, core PCE hovered at 2.90% YoY⁶, and CPI stayed 2.70% YoY—while trade frictions amplified cost pressures: average U.S. tariffs hit 20%, a new 25% levy on Indian goods lifted some duties to 50%, and a 90-day U.S.–China tariff truce merely averted steeper hikes as U.S. agriculture exports to China fell 53% in H1⁷. Despite a Q2 GDP⁸ upgrade to 3.30% SAAR⁹, underlying private demand near 1.90% and modest July retail sales (+0.50%) signaled moderating momentum. By August 31, concerns over inflation, Fed independence, and a tech selloff pulled the S&P 500 down 0.64%, with markets pricing an 86–89% chance of a 25 bp¹⁰ cut and the September 1 jobs report set to guide the next leg for rates and equities.

Looking ahead, I anticipate a choppy, range-bound September in which a likely 25 bp cut intersects a cooling labor market and still-elevated services/tariff inflation. That mix should support credit and select cyclicals while capping equity multiples, keeping leadership narrow and factor rotations sensitive to incremental data. Inflation risks persist (hot PPI, core PCE at 2.90% YoY, CPI near 2.80% YoY, and average tariffs around 20%), and growth appears to be downshifting beneath the headline Q2 print, even as consumption remains resilient with a low 4.40% saving rate limiting disinflation speed. I hold a measured confidence in a soft-landing path—plausible but not assured—expecting spreads to grind tighter after a cut, yields to stay range-bound, and equity performance to hinge on the labor prints and earnings quality, with the September jobs report a key catalyst for rates and style rotation.

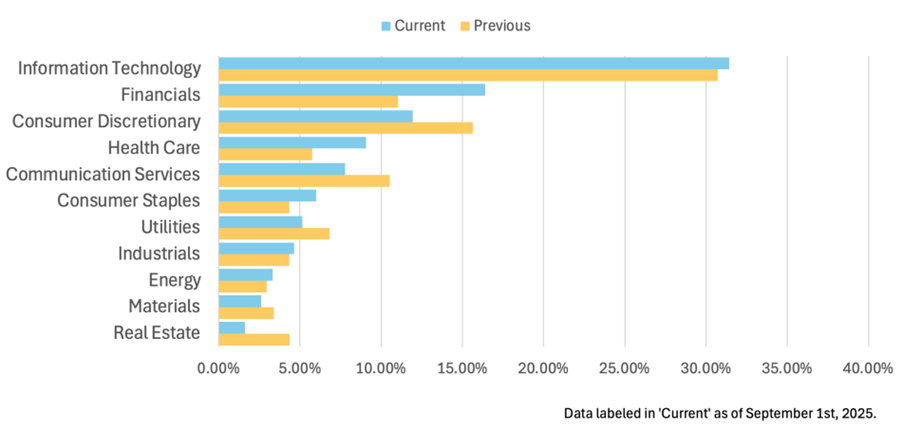

To align the portfolio with this backdrop and outlook, I moved to a barbell of large banks and AI-exposed tech balanced by defensives, while trimming rate-sensitive real estate and ad-dependent communications. Financials rose from 9% to 16.40% via additions to diversified banks (JPM, C, GS, WFC, USB, PNC, BK, SCHW) and trims/exits in prior holdings (reduced BRK.B and HOOD; exited BX/V) to benefit from easier financial conditions, narrower credit spreads, and potential trading/IB¹¹ strength post-cut. I lifted Health Care from 5.80% to 9.10% (UNH, JNJ, MRK, LLY, KVUE, ABBV, ELV, ABT, BMY) and Consumer Staples from 4.30% to 6% (KO, KHC, WMT, PEP) for earnings durability as hiring cools and services inflation stays sticky. Within Tech (up to 31.80%), I leaned into AI compute and infrastructure—raising AAPL, AMD, PLTR and adding MRVL, INTC, DELL, ADSK, CRWD—while modestly trimming NVDA and reducing MSFT, GOOGL, and META. In Consumer Discretionary (down to 12%) I concentrated into TSLA (raised) and resilient e-commerce (AMZN, MELI, CPNG) while exiting labor-sensitive names (NKE, CVNA, EBAY, ABNB, SHOP, DASH). I cut Real Estate from 4.40% to 1.60% (reduced VICI, HST; exited O, INVH) and kept Utilities lean overall despite select upgrades (EXC, PCG; added NEE, ED) given refinancing and tariff-driven cost risks, while modestly increasing Energy (XOM, CVX, EQT, FANG, SLB) as an inflation hedge and maintaining selective Industrials/Materials tied to capex¹² and AI build-outs (HWM, TDG, HEI.A, ROP, LIN, FCX). This positioning seeks to capture upside from a cut-supported credit backdrop and ongoing AI investment, with defensives to buffer volatility from sticky inflation and softer employment.

Portfolio Overview

Top Holdings – NVDA

NVIDIA enters September in a volatile but constructive setup as policy-enabled access to China and broad global AI buildouts offset regulatory and supply-chain risks; following results that confirmed strong AI infrastructure demand and guidance around $54 billion for the October quarter, LQAI kept NVIDIA as a top-three and largest position but trimmed the weight to 6.51% from 7.01%, redeploying into complementary AI beneficiaries (TSLA, PLTR, AMD), bolstering liquidity in Financials, and lifting overall Technology exposure to 31.77%. The late-August U.S.–China export framework reinstates licenses for China-compliant H20 parts and introduces a 15% remit of China chip sales to the U.S., reopening a critical channel and potentially adding up to $5 billion near term while modestly pressuring margins; this warranted a measured trim but not a reduction in strategic conviction. Supply-chain signals are mixed—TSMC’s 2nm leadership supports NVIDIA’s roadmap, while new U.S. licensing requirements for SK Hynix and Samsung raise questions on high-bandwidth memory availability—yet structural AI memory demand remains robust, so LQAI diversified within the silicon stack (adding AMD, retaining smaller MRVL and LRCX positions) while keeping NVIDIA as the anchor. Global project momentum reinforces demand durability, including Saudi Arabia’s Humain planning hundreds of thousands of NVIDIA chips beginning with 18,000 Blackwell units and 100MW-class data centers, Japan’s next flagship supercomputer with NVIDIA, Tesla’s growing reliance on NVIDIA compute, and enterprise commentary pointing to sustained AI server appetite. Overall fundamentals and financial performance remain strong, underpinned by accelerating data center adoption and substantial near-term revenue visibility, though profitability is sensitive to China terms and memory supply; with institutions still underweight and macro conditions supportive, LQAI maintains a constructive outlook and keeps NVIDIA as a cornerstone holding into the next leg of AI deployment.

Top Holdings – TSLA

Amid intensifying legal and regulatory noise, Tesla’s setup is constructive given leadership clarity and visible AI/autonomy milestones, so LQAI increased conviction and raised Tesla to a top-three position at 6.32% (from 4.05%), second only to Nvidia, funded by concentrating within Consumer Discretionary, rotating out of lower-conviction names, and leaning into the growth tailwind from rising odds of a Fed rate cut between August 4 and September 1; the board’s approval of a 96 million-share award to Elon Musk (valued near $29 billion, vesting through 2027) is a net positive that addresses retention risk as Tesla pivots to robotaxis, FSD¹⁶, and humanoid robotics, reducing a key overhang on strategy execution despite ongoing governance debate; strategically, Tesla streamlined chip efforts by disbanding Dojo, committed to AI5/AI6¹⁷ with an inference focus, secured a reported $16.5 billion Samsung supply deal, and guided a new FSD model for late September, while launching the six-seat Model Y L in China and demonstrating pricing power with a higher-spec Cybertruck—actions that clarify near-term deliverables, enhance supplier-backed execution capacity, and strengthen monetization levers; offsetting this, a Florida jury’s Autopilot verdict, a U.S. class-action path in California over self-driving marketing, ongoing NHTSA¹⁸ scrutiny, and China’s draft rules on smart-EV recalls and advertising elevate oversight costs, so we kept Tesla top-three (not top-one) and paired it with more cash-generative Financials and resilient Tech to buffer headline volatility, underwriting that appeals, tighter safety processes, and clearer disclosures can rebuild trust and ultimately strengthen the autonomy moat; fundamentals appear supported by leadership stability, a focused AI roadmap, product cadence, and pricing power, with supplier commitments signaling capacity to execute, and while explicit financial metrics were not the driver, we see monetization and autonomy progress as key to financial performance; outlook: cautiously positive, with near-term AI/FSD milestones and product actions positioned to improve sentiment and operating leverage, balanced by diversification to navigate legal and regulatory risk.

Top Holdings – PLTR

Palantir’s momentum into early September is supported by its Aug 4 earnings beat, a raised full-year outlook, and sustained AI-driven demand across government and commercial customers, prompting me to increase PLTR from 5.04% to 5.54% and elevate it to a top-three LQAI position while rotating capital toward Financials and trimming parts of mega-cap tech; I’ve kept the position below our largest AI hardware bet to respect valuation sensitivity and sector volatility. Fundamentals remain anchored in Palantir’s unique role at the nexus of defense, AI software deployment, and mission-critical data operations with tangible adoption, evidenced by incremental federal work such as a $30 million ICE¹⁹ award. U.S. defense procurement reshuffling—pauses and cancellations of legacy efforts—opens re-bid opportunities where Palantir’s rapid, outcomes-focused delivery and cost efficiency are competitive advantages, despite political scrutiny, and this supports maintaining the top-three weight. The company’s deepening operational role in Ukraine across military and civil use cases further validates real-world efficacy and strengthens referenceability with U.S. and allied customers. Broadly, the AI investment cycle—underscored by large cloud partnerships and ongoing data-center buildouts—should sustain downstream demand for software that operationalizes AI in regulated, high-stakes environments, where Palantir is well positioned. Financially, the recent earnings beat and raised guidance highlight solid execution and a strengthening pipeline, while ongoing contract momentum underpins forward visibility. Outlook: constructive, with non-earnings catalysts, defense re-bids, and frontline validation supporting continued pipeline conversion; key risks remain valuation sensitivity and sector volatility, which are reflected in our sizing and risk controls.

Notable Changes – UNH (Upgrades)

LQAI increased UnitedHealth Group (UNH) from 0.25% to 3.31% and lifted Health Care exposure from 5.77% to 9.07% between August 4 and September 1, funded by trimming lower-conviction names, as a sentiment catalyst arrived amid elevated legal, regulatory, and cybersecurity uncertainty and we judged the catalyst-risk balance to have turned favorable. Berkshire Hathaway’s new stake is reinforcing sponsorship—supported by 19 of 28 analysts at buy-or-better and a spike in retail participation—which we expect to stabilize the shareholder base and attract long-only demand on weakness. Fundamentals have been reset with a lower 2025 earnings outlook and elevated short interest, leaving expectations compressed; we see scope for operational execution—cost management and mix—plus scale advantages to support multiple stabilization and drive mean reversion into 2026, while acknowledging compliance and penalty risks from the DOJ²⁰’s criminal probe into Optum Rx and Medicare practices, Senate scrutiny over nursing-home transfer incentives and loan repayment tactics, and the Change Healthcare breach affecting 192.7 million people. We sized UNH at 3.31%—a major upgrade but below our largest positions—and balanced it with diversified Health Care holdings (JNJ, MRK, LLY, ABBV, ELV) to mitigate idiosyncratic outcomes. Policy signals are a modest near-term positive (e.g., the court’s delay of ACA marketplace changes), though projected ACA²¹ enrollment declines from 24 million in 2025 to 18 million by 2027 could cap growth; we retain dry powder to adjust as regulatory clarity improves. Outlook: cautiously constructive—Berkshire’s endorsement, a reset fundamental bar, and UNH’s scale and cost discipline underpin improved risk-reward, while we remain vigilant on legal and cybersecurity overhangs.

Notable Changes – KO (Upgrades)

From August 4 to September 1, Coca-Cola (KO)'s setup improved, so LQAI upgraded the name to a 2.33% position and lifted Consumer Staples exposure to 6.0%, funding the move by trimming Walmart, exiting Keurig Dr Pepper, and reducing Utilities and Communication Services, reflecting a better risk/reward versus peers. Key drivers include KO’s $85 million capacity expansion at Jugos Del Valle-Santa Clara in Mexico to support faster-growing, health-leaning categories and improve efficiency; exploration of strategic options for Costa Coffee to sharpen focus on core beverages and redeploy capital toward higher-velocity platforms amid coffee cost and tariff volatility; and a favorable legal ruling dismissing the “ultra-processed/addictive to children” case, reducing a brand overhang and tail risk. Fundamentals remain solid: a diversified beverage portfolio, resilient cash generation, and investment in growth adjacencies support margins and free cash flow relative to many staples peers, with no immediate sales impact reported from India boycott rhetoric. Against a sector backdrop of tariff pressure, shifting consumer preferences toward value and health, and episodic outflows, KO is expected to serve as a higher-quality anchor within LQAI’s staples sleeve, with an outlook of steady execution and competitive positioning through late 2025.

Notable Changes – MSFT (Downgrades)

In LQAI, we trimmed Microsoft (MSFT) from 6.32% to 3.92% as near-term risk/reward looks less favorable amid mounting AI infrastructure capex pressure on cash flow, regulatory/security overhangs, and execution risks around custom silicon, reallocating to higher-beta AI beneficiaries and cyclicals (TSLA, AAPL, AMD) and to Financials (JPM, GS, MS, WFC) with cleaner catalysts and improving setup into potential rate cuts and capital markets normalization; we retain a core MSFT stake given Azure/AI momentum but with sizing aligned to risk into year-end. Fundamentals are mixed: management signaled over $30B of capex in fiscal Q1 (annualized near $120B), and Big Tech raised over $60B of investment-grade debt for AI, likely compressing near-term free cash flow and elevating execution risk; yet cloud performance remains strong with Intelligent Cloud revenue up 26% YoY to nearly $30B and third-party data pointing to Azure ~40% YoY. Still, only about 5% of enterprises effectively deploy AI today, slowing conversion of usage into margins, while “Mag 7”²² concentration (~34–40% of S&P 500 value) keeps the valuation hurdle high even with expected rate cuts. Regulatory and security factors—FTC²³ concerns about EU/UK alignment and U.S. privacy, renewed national-security scrutiny over past China-based engineers (ended in 2024), and tightened MAPP²⁴ access for some Chinese firms—add legal, reputational, and public-sector contracting uncertainty. Execution and supply-chain issues—reported delays of in-house AI chips to 2028+ extending reliance on third-party silicon and an intensifying AI talent war around OpenAI—raise cost and retention risks, partly offset by over 100 million Copilot users, OpenAI’s rapid ramp and funding, and ongoing Azure share gains. Outlook: constructive long term but tactically cautious near term; we favor smaller, flexible exposure until Microsoft narrows the hardware roadmap gap and shows clearer translation of AI adoption into durable margins at hyperscale capex levels.

Notable Changes – HOOD (Downgrades)

Given Robinhood (HOOD)’s increasingly asymmetric setup—sentiment lifted by crypto but near-term risks rising from valuation, regulation, and market-structure uncertainty—I reduced LQAI’s HOOD position from 2.33% to 0.45% and redeployed toward diversified financials and steadier cash-flow franchises expected to benefit more cleanly from Fed easing, lifting the portfolio’s Financials weight to 16.41% and spreading exposure across JPM, GS, MS, WFC, USB, C, PNC, BK, and SCHW while keeping a modest residual in HOOD for upside without outsized drawdown risk; fundamentally, HOOD’s revenue model is highly sensitive to trading activity—particularly digital assets—so earnings and engagement could falter if volumes soften, and after a sharp re-rating the margin for error appears thin, prompting a sizing reduction to balance risk-reward; policy signals have also turned murkier (SEC²⁵ reassessment of short-selling rules, questions around Fed independence) with potential implications for broker compliance costs and market structure, reinforcing a tilt to better-capitalized, more diversified platforms; while the crypto backdrop and supportive research stances may support engagement and near-term results, we chose tighter risk via a small HOOD stake plus limited crypto-levered exposures (e.g., COIN, MSTR) and a barbell of quality financials and durable growth, mindful that consumer-spending bifurcation, tariff-related cost pressures, and higher debt burdens could temper retail risk appetite and weigh on activity-sensitive platforms; outlook: cautiously constructive but risk-aware—maintain a small position to capture crypto and engagement tailwinds, remain underweight until valuation, regulatory clarity, and volume durability improve.

Footnotes

¹ Consumer Price Index and Personal Consumption Expenditures, two key inflation measures; CPI tracks consumer prices, while PCE reflects broader household spending. ² Producer Price Index, a measure of inflation based on average changes in prices received by producers. ³ A measure of volatility relative to the overall market (beta>1 means higher volatility than the market). ⁴ A U.S. stock market index tracking 30 large, publicly owned companies. ⁵ Month-over-Month, a comparison of a statistic or value with the previous month. ⁶ Year-over-Year, a comparison of a statistic or value with the same period one year earlier. ⁷ First half of the year (January through June). ⁸ Gross Domestic Product, the total monetary value of all goods and services produced in a country. ⁹ Seasonally Adjusted Annual Rate, an economic measure that adjusts for seasonal variations and annualizes short-term data. ¹⁰ Basis point, a unit of measure for interest rate or yield changes (1 bp = 0.01%). ¹¹ Investment Banking, the division of a financial institution that provides advisory, underwriting, and capital-raising services to corporations, institutions, and governments. ¹² Capital expenditure, the money a company spends on long-term investments such as equipment, facilities, or technology. ¹³ NVIDIA’s China-compliant AI graphics processing unit (GPU), designed to meet U.S. export restrictions while enabling continued sales into China. ¹⁴ Taiwan Semiconductor Manufacturing Company, the world’s largest dedicated semiconductor foundry, producing advanced chips for global technology firms. ¹⁵ SK Group (South Korea), a conglomerate whose affiliates such as SK hynix are major players in semiconductor memory and technology industries. ¹⁶ Full Self-Driving, Tesla’s advanced driver-assistance system aiming for autonomous vehicle capability. ¹⁷ Tesla’s in-house AI chip programs, with AI5 and AI6 designed for training and inference in autonomous driving systems. ¹⁸ National Highway Traffic Safety Administration, the U.S. federal agency responsible for vehicle safety standards and enforcement. ¹⁹ U.S. Immigration and Customs Enforcement, a federal agency under the Department of Homeland Security responsible for immigration enforcement and investigations, often awarding technology and data contracts. ²⁰ U.S. Department of Justice, the federal executive department responsible for law enforcement, legal affairs, and criminal investigations. ²¹ Affordable Care Act, U.S. health care reform law enacted in 2010 aimed at expanding insurance coverage, controlling health care costs, and improving the health care system. ²² “Magnificent Seven,” an informal term referring to the seven largest U.S. mega-cap technology stocks (commonly AAPL, MSFT, AMZN, GOOGL, META, TSLA, NVDA) that drive a significant portion of S&P 500 performance. ²³ Federal Trade Commission, a U.S. government agency responsible for protecting consumers and promoting competition through enforcement of antitrust and consumer protection laws. ²⁴ Microsoft AI Platform Partnerships, Microsoft’s access and collaboration program for AI platforms and services, sometimes restricted for firms in sensitive jurisdictions. ²⁵ U.S. Securities and Exchange Commission, the federal agency responsible for regulating securities markets, protecting investors, and overseeing broker-dealers, exchanges, and investment funds.

Disclosure

For a list of the top 10 fund holdings, please visit www.qraftaietf.com/lqai. Fund holdings are subject to change.

About Qraft Technologies

Qraft Technologies is a fintech company aiming to drive growth in the asset management industry through its innovations in artificial intelligence (AI) and investing. Qraft offers a variety of AI-powered investment solutions, including a security selection engine, asset allocation engine, robo-advisory solution and an AI order-execution system. From data processing to alpha research and portfolio execution, Qraft has an established track record in developing cutting-edge AI solutions that have been adopted by over 25 financial institutions worldwide. In 2022, Qraft received a US$146 million investment from SoftBank Group, entering into a strategic partnership to accelerate AI in the asset management industry.

About LG AI Research

Launched in December 2020 as the artificial intelligence (AI) research hub of South Korea's LG Group, LG AI Research aims to lead the next epoch of artificial intelligence (AI) to realize a promising future by providing optimal research environments and leveraging state-of-the-art AI technologies. And LG AI Research developed its large-scale AI, EXAONE, a 300 billion parametric multimodal AI model, in 2021. EXAONE, which stands for “Expert AI for Everyone,” is a multi-modal large-scale AI model that stands out from its peers due to its ability to process both language and visual data. With one of the world’s largest learning data capacities, LG AI Research aims to engineer better business decisions through its state-of-the-art artificial intelligence technologies and its continuous effort on fundamental AI research. For more information, visit https://www.lgresearch.ai/.