Turning the Dimmer, Not theSwitch: Dialing Up Platforms,Adding Utilities as Ballast

To download a PDF version of this report, click here

The performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than their original cost. Returns for periods of less than one year are not annualized. Performance results, current to the most recent month end may be obtained by visiting Qraft AI ETFs at www.qraftaietf.com/lqai. (As of 09/29/25)

Performance Overview

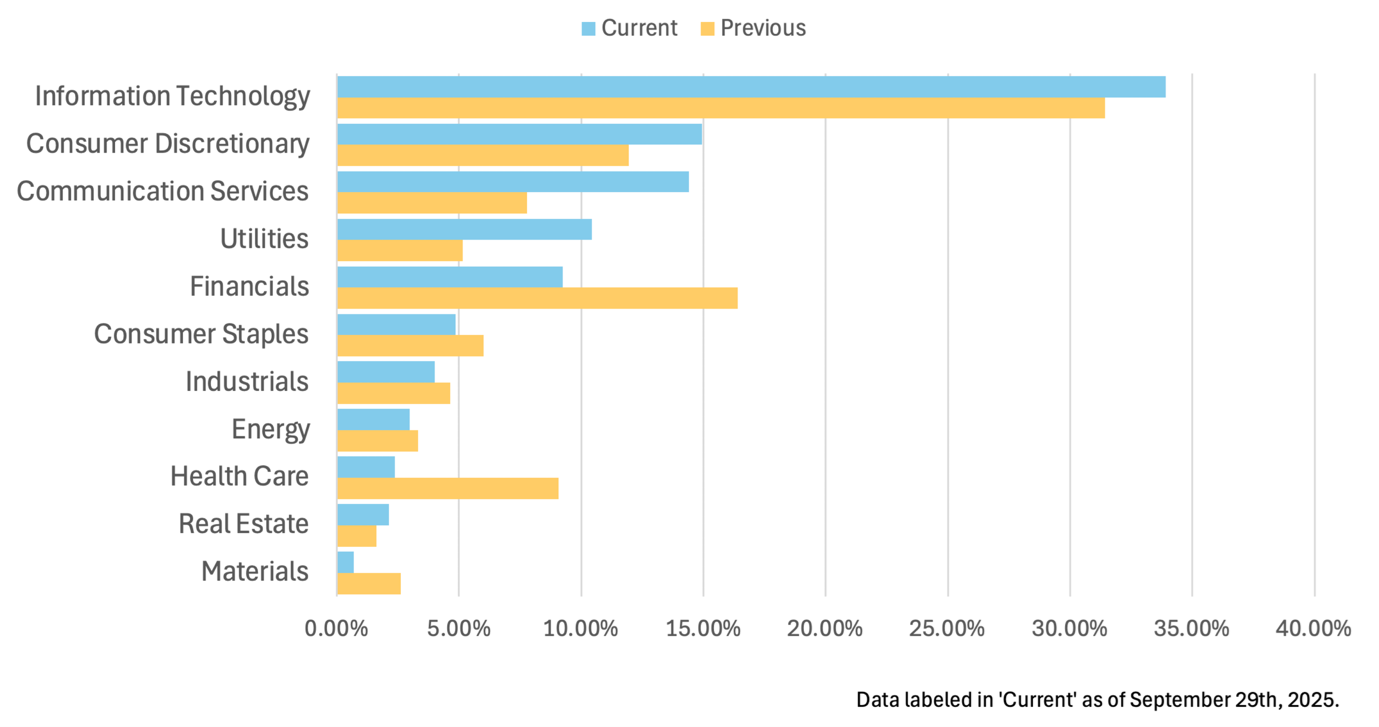

In September, the portfolio before the rebalancing delivered a strong 6.34% gain with a shallow -1.54% max drawdown and a modest 0.07 Sharpe, performing slightly better than the S&P 500, which also finished the month higher as indices reached record levels following the Fed’s 25 bp cut¹ on September 17 to 4.00–4.25%. Results were driven by the overweight in Information Technology (31.77%) and exposure to mega-cap/AI leaders (NVDA, MSFT, AAPL, AMD, PLTR) and growth platforms in Communication Services (GOOGL, META, NFLX), which benefited from easing-policy hopes and a risk-on tilt³ even as labor data softened (August payrolls +22k, unemployment 4.3%).

Consumer Discretionary names (TSLA, AMZN) added to upside amid resilient spending, while the sizable Financials weight (16.41%) muted some gains as rate-cut expectations and curve dynamics pressured bank earnings power and coincided with notable equity-fund outflows. The daily pattern—multiple +0.8–1.1% up days around 9/9–9/12 and post-Fed strength on 9/18–9/19, followed by a brief pullback into 9/25 amid shutdown risks and mixed inflation prints (CPI⁵, PPI⁶)—reflected a macro backdrop of cooling labor markets, gradual disinflation, and tariff-driven margin pressures.

Monthly Review

U.S. equities hit fresh records mid-September on rate-cut expectations but finished the month on shakier ground as a cooling labor market, mixed inflation, and policy/geopolitical cross-currents lifted volatility. The Fed’s 25 bp cut supported multiples, but August payrolls added only 22,000 (vs. 75,000 expected) and unemployment rose to 4.3%, while jobless claims briefly spiked before easing to 218,000. Equity funds saw $43.2 billion of outflows, the Empire State index fell to -8.7, and housing starts dropped 7.0%. Safe-haven demand pushed gold to a record near $3,790/oz by September 23. At the same time, Q2 GDP was revised up to 3.8% and PCE inflation rose 2.5%, complicating the Fed’s easing cadence.

Technology faced policy headwinds, including a proposal for a $100,000 H-1B visa fee that could compress margins, and renewed trade frictions with China and India.

Against this backdrop, the portfolio was tilted toward rate-sensitive defensives and high-quality platforms while trimming cyclicals and margin-at-risk exposures. Utilities rose to 9.32% and Real Estate to 2.13% to benefit from lower discount rates and provide downside ballast. Information Technology increased to 35.01%, refocused on durable cash engines and AI beneficiaries (NVDA, PLTR, MSFT, AAPL, AVGO) balanced with ORCL, CSCO, IBM, HPQ, HPE, and MCHP. Communication Services rose to 14.03% (GOOGL, META, CMCSA, EA, NFLX, TTWO) on ad recovery and platform monetization. Consumer Discretionary reached 14.93% with selective exposures (AMZN, TSLA, F, CCL, QSR) sized conservatively. Financials were trimmed to 9.25%, emphasizing resilient deposit franchises (HBAN, FITB, USB, TFC, BAC, NU). Health Care (2.37%) and Energy/Materials (2.25% / 0.69%) were kept small, with a gold hedge (NEM) maintained. The goal is to participate in rate-cut-supported upside while reinforcing downside protection against labor softness and policy/geopolitical shocks.

Portfolio Overview

Top Holdings – NVDA [6.73% of portfolio]

NVIDIA remains a top-three holding at 6.72% (up from 6.51%), lifted alongside Information Technology exposure to 35.01%. Developments included a letter of intent with OpenAI to deploy at least 10 GW of NVIDIA systems and NVIDIA’s plan to invest up to $100 billion as deployments proceed. NVIDIA also committed $5 billion to Intel to bolster domestic manufacturing capacity, unveiled Rubin CPX for scale-out inference, and reinforced positioning through Europe’s JUPITER exascale system launch on Grace Hopper and the opening of the first AI Technology Center in the Middle East with Abu Dhabi’s TII. Policy risks remain elevated: reports indicated China regulators requested firms halt purchases of NVIDIA AI chips and initiated a preliminary anti-monopoly probe. To balance these risks, the portfolio paired NVIDIA with U.S.-aligned infrastructure exposures. Fundamentals remain strong, supported by demand visibility, strategic partnerships, and diversified R&D investments including participation in quantum ventures such as Quantinuum and PsiQuantum.

Top Holdings – PLTR [6.66% of portfolio]

Palantir rose to a top-three position at 6.66% (from 5.54%), supported by expanding defense and commercial AI momentum. In September, the U.S. Army signed a 10-year enterprise agreement with a ceiling value up to $10 billion, consolidating more than 75 contracts into a single framework and validating Palantir’s core defense role. Palantir reported quarterly revenue surpassing $1 billion, largely driven by government work, with U.S. revenue up 68% year-on-year. Partnerships with Boeing in aerospace and with Lumen in telecom illustrate diversification beyond government and reinforce adoption of Palantir’s platforms. Multi-year backlog visibility, deep workflow integration, and increasing commercial validation justify Palantir’s maintained top-three weight.

Top Holdings – TSLA [6.09% of portfolio]

Tesla remains a top-three holding at 6.09% (trimmed from 6.32%) while Consumer Discretionary exposure increased to 14.93%. Positive developments included a $16.5 billion multi-year chip supply agreement with Samsung, Arizona approval to begin robotaxi testing with ambitions to expand coverage toward half the U.S. population by year-end, and Panasonic’s next-generation battery roadmap targeting ~25% capacity gains (~90 additional miles of range for Model Y). Regional challenges included European registration declines (France -47.3%, Sweden -84% in August) and policy headwinds, such as India’s proposal to increase EV GST rates and Mexico’s new 50% tariff on Chinese imports, potentially affecting Shanghai-built exports. Execution remains supported by chip sourcing, autonomy initiatives, and refreshed offerings, though policy and regulatory risks warrant disciplined sizing.

Notable Changes – AVGO (Upgrades) [3.67% of portfolio]

Broadcom was upgraded to a top-ten LQAI position, with its weight rising from 0.34% to 3.67% and Information Technology exposure lifted to 35.01%. In its July quarter, Broadcom reported revenue of $15.95 billion, net income of $4.14 billion, and guided next quarter revenue to $17.4 billion. AI semiconductor revenue is expected to accelerate to $6.2 billion (from $5.2 billion), supporting confidence in earnings visibility. Reports of a $10 billion AI chip order and external estimates raising fiscal 2026 AI sales expectations above $40 billion validated Broadcom’s role as a scaled AI supplier.

Notable Changes – ORCL (Upgrades) [2.58% of portfolio]

Oracle was upgraded to a 2.58% position on the back of a materially stronger OCI backlog and demand backdrop. The company disclosed remaining performance obligations of $455 billion, up 359% year-on-year, with management guiding OCI revenue to rise from $18 billion this year toward $144 billion in four years. Press reports indicated a $300 billion cloud agreement with OpenAI under the Stargate initiative, targeting up to 10 GW capacity, while negotiations with Meta for a ~$20 billion deal are ongoing. Oracle also continues to host U.S. TikTok data through its infrastructure. To fund capacity expansion, Oracle raised $18 billion in bonds and guided FY26 capex of ~$35 billion. Leadership transitioned to a co-CEO model with Clay Magouyrk and Mike Sicilia, while Safra Catz became Executive Vice Chair. Risks include high leverage, capex intensity, and execution on backlog conversion, but backlog visibility and positioning in AI infrastructure underpin the constructive upgrade.

Notable Changes – AMD (Downgrades) [0.38% of portfolio]

AMD was reduced from 3.47% to 0.38%. The decision reflected deteriorating competitive positioning as NVIDIA deepened partnerships with Intel and OpenAI, and as alternative platforms drew procurement interest. Regulatory risks, including potential changes to U.S. corporate taxes intersecting with AMD’s China-related revenues and ongoing export-control uncertainties, add to earnings fragility. While sector enthusiasm for AI remains supportive, AMD’s relative capture of AI revenue remains uncertain, justifying a small placeholder position.

Notable Changes – UNH (Downgrades) [0.32% of portfolio]

UnitedHealth Group was cut from 3.31% to 0.32%, reducing Health Care exposure from 9.07% to 2.37%. Federal investigations into Medicare billing and pharmacy benefit managers, coupled with rising medical costs, pose near-term risks. While management expects about 78% of members in 4-star-or-better Medicare Advantage plans for Star Year 2026, tougher thresholds could pressure bonus reimbursements into 2027. UNH reaffirmed at least $16 in adjusted EPS for 2025, but profitability remains clouded by policy risks at OptumRx and elevated cost trends. Given the regulatory backdrop, the position is maintained only at a monitoring weight.

Footnotes

¹ A basis point (bp) is a unit used to measure changes in interest rates or yields, where 1 bp = 0.01%. ² Capital expenditure refers to the money a company spends on long-term investments such as equipment, facilities, or technology. ³ The term “risk-on tilt” describes assets or strategies that tend to be more volatile than the overall market, typically having a beta greater than 1. ⁴ Concentration risk refers to the potential losses that arise when investing heavily in a small number of assets, industries, or regions. ⁵ The Consumer Price Index (CPI) measures inflation based on the average change in prices paid by consumers, while ⁶ the Producer Price Index (PPI) measures inflation based on the average change in prices received by producers.

Disclosure

For a list of the top 10 fund holdings, please visit www.qraftaietf.com/lqai. Fund holdings are subject to change.

About Qraft Technologies

Qraft Technologies is a fintech company aiming to drive growth in the asset management industry through its innovations in artificial intelligence (AI) and investing. Qraft offers a variety of AI-powered investment solutions, including a security selection engine, asset allocation engine, robo-advisory solution and an AI order-execution system. From data processing to alpha research and portfolio execution, Qraft has an established track record in developing cutting-edge AI solutions that have been adopted by over 25 financial institutions worldwide. In 2022, Qraft received a US$146 million investment from SoftBank Group, entering into a strategic partnership to accelerate AI in the asset management industry.

About LG AI Research

Launched in December 2020 as the artificial intelligence (AI) research hub of South Korea's LG Group, LG AI Research aims to lead the next epoch of artificial intelligence (AI) to realize a promising future by providing optimal research environments and leveraging state-of-the-art AI technologies. And LG AI Research developed its large-scale AI, EXAONE, a 300 billion parametric multimodal AI model, in 2021. EXAONE, which stands for “Expert AI for Everyone,” is a multi-modal large-scale AI model that stands out from its peers due to its ability to process both language and visual data. With one of the world’s largest learning data capacities, LG AI Research aims to engineer better business decisions through its state-of-the-art artificial intelligence technologies and its continuous effort on fundamental AI research. For more information, visit https://www.lgresearch.ai/.