Threading the Needle: Stitching a Soft Landing with Silicon at the Core

To download a PDF version of this report, click here

Fund holdings are subject to change. For a full list of fund holdings and to view the top 10 positions, please visit www.qraftaietf.com/lqai.

Performance Overview

Over the last month, the portfolio before the rebalancing delivered a modest gain of 0.89%, with a maximum drawdown of 3.32% and a subdued ²Sharpe of 0.03, reflecting a choppy backdrop shaped by the ³government shutdown, escalating tariff rhetoric, and shifting Fed expectations; performance troughs were most visible during the mid-month ⁴risk-off episode (10/10: -3.18%), while recoveries aligned with softer ⁵inflation (⁶CPI +0.30% MoM headline, +0.20% MoM core; both 3.00% YoY) and a 97%+ implied probability of an October rate cut that supported ⁷duration-sensitive mega-cap technology and communication services exposures. The prior overweight to Information Technology, Communication Services, and Consumer Discretionary helped into the late-month rebound, while exposure to ⁸cyclicals and financials contended with weaker trade data (container imports -7.30% in September), tariff headlines (including talk of 100% China tariffs), and labor softness (⁹ADP -32,000; claims rising), partly offset by Utilities acting as ¹⁰ballast as yields fell and gold surged to record highs. On balance, the strategy performed slightly better than the S&P 500 (0.60%) amid elevated volatility, with early-month shutdown uncertainty and mid-month trade shocks giving way to rate-cut optimism that lifted higher-quality growth. In response to these conditions, the portfolio after the rebalancing increases emphasis on resilient, rate-sensitive technology and quality compounders while trimming financials and energy and maintaining defensive ballast, aiming to navigate ongoing ¹¹policy-driven volatility and a cooling, disinflating macro trajectory.

Monthly Review

Over the past month (late September through October 27), the U.S. appeared to be threading a fragile soft-landing, with inflation easing toward 3.00% and growth moderating while markets swung on shutdown and tariff headlines alongside mounting expectations of imminent Federal Reserve easing. September CPI rose 0.30% MoM and 3.00% YoY, with core at 0.20% MoM and 3.00% YoY as shelter decelerated and energy lifted the headline, aligning with a dovish Fed after Septemberʼs 25 bp cut and market odds of another cut rising to 97.00%–99.00% into the October 28–29 meeting. The October 1 government shutdown delayed data and dented sentiment—estimated to be costing roughly $15.00 billion per day—while labor signals softened (ADP −32,000 jobs; initial claims 235,000). Trade risks intensified—proposed 100.00% tariffs on Chinese goods by November 1, a 10.00% tariff on Canadian imports, and rare-earth tensions—contributing to a 7.30% decline in September U.S. container imports (−22.90% from China). Equities reflected the crosscurrents: the S&P 500 rose 0.34% on October 1 on rate-cut hopes, then fell 2.71% (Nasdaq −3.56%) on October 12 after tariff headlines; safe-haven demand sent gold to successive records, peaking at $4,378.69 per ounce as Treasury yields slid. A cooler inflation print and firmer earnings expectations (Q3 S&P 500 ~9.20% YoY) supported a late-month rebound, with the Dow up 562.73 points (+1.21%) to 47,297.34 on October 24 and 1.01% higher by October 26. The ¹²Beige Book described overall activity as little changed amid weak manufacturing, tariff-related cost pressures, and uneven consumer demand, while national debt reached $37.88 trillion. Net-net, financial conditions eased and upper-income consumption held up, but shutdown uncertainty and trade policy dominated risk premia, leaving equities reliant on a supportive Fed to offset softer labor momentum and external demand headwinds.

Looking ahead to next month, we expect the soft-landing to extend, with disinflation hovering near 3.00% YoY and a highly probable Fed rate cut providing a backstop for risk assets, even as shutdown duration, tariff implementation, and energy volatility keep cross-asset chop elevated. Labor momentum has cooled and the Beige Bookʼs “little changed” tone underscores a slower manufacturing pulse, while the shutdownʼs drag and data delays cloud near-term visibility. Still-easier financial conditions, resilient upper-income spending, and a firmer earnings backdrop should help cushion growth, while safe-haven demand and lower yields temper downside. On balance, we are guardedly constructive—maintaining measured confidence in a Fed-supported expansion while acknowledging a wider band of outcomes driven by policy and trade risks.

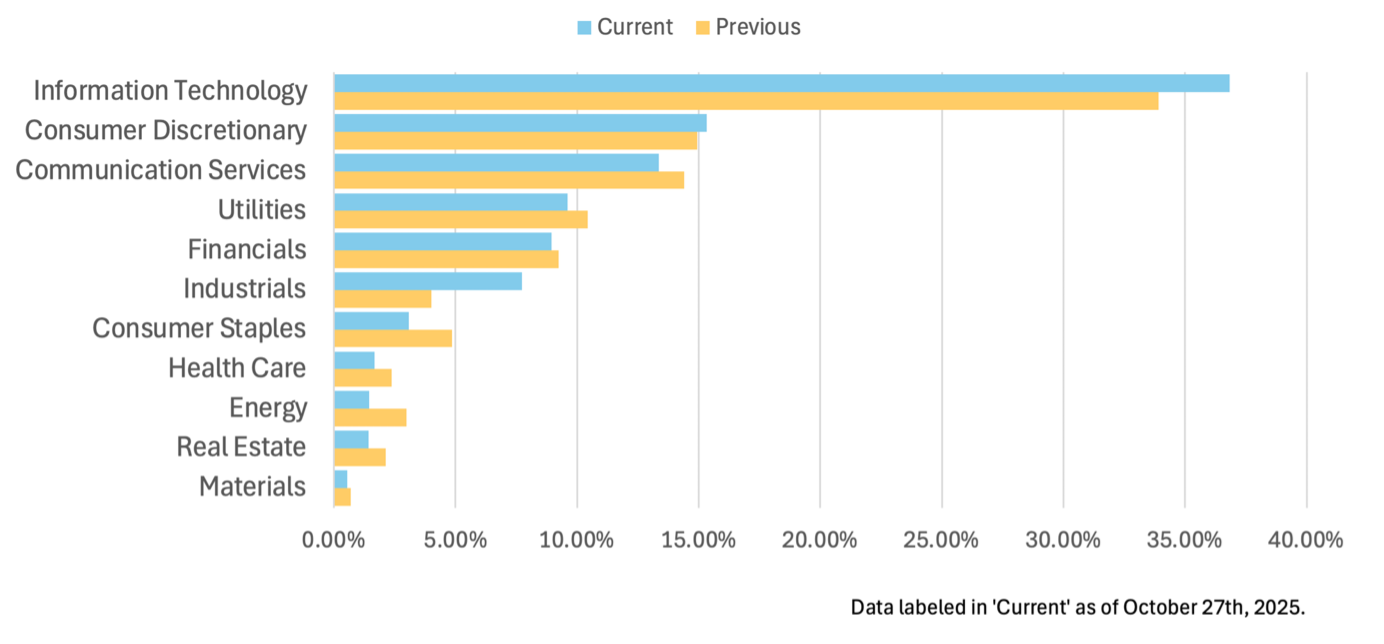

Reflecting this view, we tilted the portfolio toward long-duration growth, grid-linked utilities, and quality industrials, while trimming financials, energy, real estate, and low-beta staples to balance soft-landing upside with policy and trade uncertainty. Information Technology increased to 38.75% from 35.01%, adding semis and

AI/data-center infrastructure (AMD 4.29%, NVDA 6.70%, MSFT 4.75%, AVGO 3.62%). Communication Services was streamlined to resilient digital platforms amid upgraded earnings (GOOGL 5.52%, META 3.75%) and reduced legacy telecom to manage leverage/capex risk (T 1.04%, VZ 0.21%), taking the sector to 13.36% from 14.03%. Utilities rose to 9.62% from 9.32% as rate-sensitive beneficiaries with rising power demand. Industrials climbed to 7.30% from 5.14% via high-quality, domestically oriented operators with pricing power and secular tailwinds. Financials were trimmed to 7.30% from 9.25% given softer labor, shutdown uncertainty, and tighter credit transmission to regionals while favoring fee/fintech exposure (HOOD 2.33%). Energy decreased to 1.44% from 2.25% amid trade headwinds and mixed fuel-price signals

(XOM, SLB, OXY), and Real Estate moved to 1.43% from 2.13% while leaning into data centers and scaled-back net lease. Consumer Staples shifted to 3.09% from 4.87%, keeping selective brands geared to resilient upper-income demand. Materials held 0.70% with a higher gold allocation (NEM 0.35%) and selective uranium to hedge volatility. Consumer Discretionary nudged to 15.33% from 14.93%, rebalancing toward diversified, quality growth (TSLA 5.25%, AMZN 2.68%). This positioning seeks to participate in a Fed-supported soft landing while maintaining discipline against shutdown and tariff downside risks.

Portfolio Overview

Top Holdings – NVDA [6.70% of portfolio]

LQAI keeps NVIDIA as a top-3, overweight position at 6.70% (vs. 6.72% prior) while modestly redeploying capital to broaden exposure across the AI stack, lifting overall Information Technology to 38.75% and adding complementary holdings (AMD 4.29%, INTC 2.23%, MU 1.51%, WDC 1.52%, SMCI 0.23%, VRT 0.37%, DLR 0.34%). NVIDIAʼs fundamentals remain defined by sustained leadership in AI infrastructure, a dominant software/developer ecosystem, and improving supply-chain resiliency, reinforced by onshoring progress (the first U.S.-made Blackwell wafer at TSMCʼs Arizona fab on advanced nodes) and multi-year infrastructure buildouts (e.g., UK data-center spend projected to reach £10 billion annually by 2029 and Taiwanʼs AI-led semiconductor expansion with TSMC at the core). Strategic partnerships and capacity commitments deepen demand visibility and platform stickiness: up to $100 billion in data-center chips committed to OpenAI; a $2 billion investment in xAI; participation in Reflection AIʼs $2 billion round; expanded collaborations with UiPath and Fujitsu; an autonomous-vehicle data collaboration with Uber; a consortium agreement to acquire Aligned Data Centers for $40 billion; and Nscaleʼs deal to supply Microsoft with roughly 200,000 NVIDIA AI chips worth up to $14 billion. While competition is rising—AMDʼs multi-year OpenAI deal with deployments starting in late 2026, OpenAIʼs plan with Broadcom for 10 gigawatts of custom chips between 2026–2029, Googleʼs >1 gigawatt of TPUs for Anthropic, NextSiliconʼs Maverick-2 funding, and CXMTʼs HBM3 ambitions for 2026—most alternatives are back-end loaded, leaving NVIDIAʼs near-term advantage intact. The portfolio maintains NVIDIAʼs central role while scaling a competitive hedge via AMD and ecosystem beneficiaries (memory, storage, servers/integration, power/cooling) to capture value across scenarios. Outlook: NVIDIA remains the reference platform for AI over the rebalancing horizon, with robust fundamentals and a supportive financial performance backdrop implied by durable demand pipelines, deep partner commitments, and increasing domestic capacity, even as regulatory and competitive crosscurrents are monitored.

Top Holdings – GOOGL [5.52% of portfolio]

At this rebalance, LQAI increased Alphabet Inc. (GOOGL) from 4.04% to 5.52% to make it the second-largest position, while trimming Communication Services from 14.03% to 13.36% and consolidating within the sleeve toward AI-at-scale platforms—chiefly Alphabet—amid accelerating AI-and-cloud adoption balanced against higher regulatory and competitive scrutiny; evidence of momentum includes Gemini Enterprise customer wins (Gap, Figma, Klarna), in-negotiation multibillion cloud-and-TPU work with Anthropic (up to one million TPUs), LA28 naming Google as official cloud provider, a €5 billion Belgium data-center expansion, Broadcom custom AI silicon optionality, and large-scale data-center commits in India, supporting the decision to elevate GOOGL to a top-three weight to capture compounding optionality across Google Cloud, Search augmentation, and enterprise workflows; YouTubeʼs multi-year NBCUniversal deal secures marquee linear and sports content for YouTube TV, helps protect a roughly 10 million-subscriber base, preserves Peacock integration, and, alongside YouTubeʼs leading U.S. TV viewing share, strengthens subscription stickiness and high-intent ad inventory, justifying concentrated exposure to the YouTube ecosystem; regulatory developments (U.S. Supreme Court refusal to stay Play Store remedies, UK CMA

“strategic market status” in search, and California AI risk disclosures) imply higher compliance costs and product adjustments, but recent settlements (including YouTube litigation with Donald Trump) and trust/security measures (e.g., the Wiz cybersecurity acquisition) demonstrate an ability to de-risk legal overhangs and harden infrastructure; fundamentals remain strong with scaled AI infrastructure and diversified revenue engines across ads, cloud, and subscriptions, and operational traction and capacity expansion support durable growth potential, so the outlook is constructive—LQAI remains overweight GOOGL, accepting near-term headline volatility in exchange for long-term advantages in AI-driven compute, monetization, and diversified financial performance.

Top Holdings – TSLA [5.25% of portfolio]

Tesla enters this rebalance amid heightened U.S. regulatory scrutiny of ¹³FSD (NHTSAʼs 2.88 million-vehicle probe, senatorsʼ calls for investigation, and recalls of 12,963 Model 3/Y and 63,619 Cybertrucks) offset by product moves, supportive U.S. industrial policy, and expanding energy initiatives; after the Oct 22 print showing record revenue of $28.10 billion with ¹⁴EPS of $0.50 versus EPS estimated $0.55, LQAI trimmed Tesla from 6.09% to 5.25% to reflect near-term regulatory risk but kept it a top-three position (behind NVDA at 6.70% and GOOGL at 5.52%) while raising Consumer Discretionary exposure from 14.93% to 15.33%.

Policy shifts are a net positive: expanded U.S. production credits (effective 2025-10-18), a 25% tariff on imported medium- and heavy-duty trucks starting 2025-11-01, proposed tariff relief for U.S. auto production (2025-10-03), and floated 100% tariffs on Chinese imports (2025-10-10) bolster Teslaʼs domestic manufacturing advantage, with Mexicoʼs proposed tariff hikes (up to 50%) and Norwayʼs phase-out of EV tax exemptions as manageable regional headwinds.

Product strategy turned more cautious near term with lower-priced Standard Model Y ($39,990) and Model 3 ($36,990) slated for Dec 2025/Jan 2026 deliveries, but it broadens the addressable market post-credit and is supported by operational follow-through as Shanghai ramps (including a new six-seater) with September sales up 2.80% year over year, enhancing supply flexibility and cost leverage.

Diversification in energy storage is accelerating—UGLʼs 164 MW/905 MWh Muchea project (target 2027), Australiaʼs pipeline of 44 batteries exceeding 10 GW, and deployments like the 250 MW Calala BESS using Autobidder—supporting higher-quality, software-enabled recurring revenue that offsets cyclical auto exposure.

Notable Changes – AMD (Upgrades) [4.29% of portfolio]

AMDʼs AI-accelerator positioning strengthened notably on transformative partnerships and expanding ecosystem adoption despite policy volatility, prompting LQAI to increase AMD to 4.29% from 0.38% and lift the IT sector tilt to 38.75% from 35.01%, with sizing kept below larger AI platforms (e.g., NVDA 6.70%) and funded by trims to lower-conviction IT plus reallocations from staples and energy; momentum is underpinned by a multi-year AI chip supply agreement with OpenAI (roughly six gigawatts of AI compute and projected to exceed $100 billion in revenue over four years with initial recognition in 2026), Oracleʼs plan to deploy 50,000 MI450 accelerators from 3Q26, reports that OpenAI is already using AMD AI chips, and early talks with Intel that could add a foundry pathway to bolster manufacturing resilience; fundamentals and financial performance outlooks improve with these pipelines and accelerating AI infrastructure spend, supporting a step-change in Data Center growth beginning in 2026, higher long-term free-cash-flow expectations, and the ability to scale an annual cadence of AI chips leveraging TSMC capacity plus potential incremental foundry sources, while valuation and execution needs argue for measured sizing; regulatory and geopolitical risks (potential 100% tariffs on Chinese imports, shifting export controls, U.S.-China frictions, rare-earth supply exposure) drive risk-controlled positioning alongside complementary AI-infrastructure holdings (NVDA 6.70%, AVGO 3.62%, MU 1.51%, WDC 1.52%, VRT 0.37%); overall, the outlook is constructive, with expected acceleration from 2026 as partnerships convert to shipments and revenue, supporting margin expansion and stronger free cash flow, tempered by ongoing execution and policy risks.

Notable Changes – HOOD (Upgrades) [2.33% of portfolio]

Amid strengthening momentum and expanding monetization, LQAI raised HOOD from 0.29% to 2.33% on 2025-10-27—one of the monthʼs largest upgrades—despite trimming the overall Financials sleeve from 9.25% to 7.30%, reflecting high conviction tempered by platform-dependency risk highlighted by the 2025-10-20 AWS outage. Fundamentally, revenue diversification is advancing: event contracts have surpassed$200 million in annual revenue as of September 2025, with Robinhood users contributing an estimated 25%–35% of daily Kalshi volume, while international expansion with low-cost investment products in the UK broadens the addressable market and supports more durable transaction and subscription income. Sentiment and liquidity are further supported by recent analyst upgrades and S&P 500 inclusion, which can drive incremental index and quantitative flows, though momentum can amplify volatility and warrants measured sizing. Market-structure tailwinds, including Cboeʼs extended trading hours and Robinhoodʼs push for more flexible access, should incrementally lift options and related activity, enhancing engagement and monetization. Outlook: positive, with catalysts across product, geography, and market access supporting scalable topline growth, balanced against operational dependencies that keep risk management paramount.

Notable Changes – PLTR (Downgrades) [3.67% of portfolio]

Palantir Technologies was downgraded to a higher-risk, lower-conviction holding and the LQAI portfolio reduced its weight from 6.66% to 3.67%, redeploying the trimmed 2.99% within Information Technology toward AI infrastructure and beneficiaries with clearer near-term delivery while keeping a smaller position for upside optionality if execution improves. Sentiment deteriorated after a U.S. Army memo (2025-09-29 to 2025-10-05) labeled the Anduril-linked NGC2 prototype “very high risk,” citing potential persistent, undetectable access and an overly permissive authorization model that could expose all applications and data irrespective of clearance—raising reputational risk, scrutiny, and the likelihood of delayed or canceled classified programs, elongated sales cycles, and higher remediation costs. Fundamentals also signaled caution: while Palantir announced a multi-year commitment exceeding $200 million from Lumen, the structure implies revenue recognized over several years rather than a near-term inflection, no new earnings report fell in the 2025-09-29 to 2025-10-27 window to refresh guidance, and the NGC2 issues add downside risk to the defense pipeline and potential compliance costs. Positive commercial and government updates—including the Lumen agreement and a letter of intent with Polandʼs Defense Ministry expected to be signed on 2025-10-27—support Palantirʼs position in AI-enabled analytics and defense modernization, but remain early-stage and arrive amid broader industry reliability and security scrutiny (e.g., the major AWS outage and F5 breach during 2025-10-20 to 2025-10-26) that can lengthen diligence and procurement. Overall, LQAI maintains a measured 3.67% position to participate in potential long-term gains while expecting near-term execution, accreditation, and compliance challenges to constrain results; the outlook is cautiously neutral, with improvement contingent on resolving security findings and converting pipeline commitments into durable, recognized revenue.

Notable Changes – ORCL (Downgrades) [0.52% of portfolio]

LQAI reduced Oracle from 2.58% to 0.52% as near-term risk-reward deteriorated on margin pressure, cybersecurity fallout, and execution uncertainty, while keeping an overweight in Information Technology overall (38.75% from 35.01%) and reallocating to tech names with clearer unit economics and operating leverage to AI (e.g., AMD, INTC, MU, WDC, and core AI platforms) to emphasize improving profitability and nearer-term cash conversion. Fundamentals and financial performance were key drivers: disclosures showed thin economics in growth areas (about $900 million of Nvidia server rentals yielding $125 million gross profit, a 14.00% margin for the fiscal quarter ending August 2025), a roadmap implying nearly $100 billion of ¹⁵capex over two years alongside the first negative free cash flow since 1990, and Moodyʼs highlighting high leverage with debt rising faster than ¹⁶EBITDA and likely extended negative cash flows; while managementʼs long-term targets (cloud infrastructure revenue of $166 billion and adjusted EPS of $21.00 by fiscal 2030) are ambitious, balance sheet flexibility concerns, including a planned $38 billion debt offering, reinforced risk controls.

Cybersecurity issues—cl0p-affiliated extortion against Oracle E-Business Suite customers demanding $7–50 million, with Google noting over 100 impacted companies and “mass amounts of customer data” stolen dating to July 2025 and Oracle confirming client emails—raise reputational and contractual risks likely to elongate sales cycles, intensify audits, and increase security ¹⁷opex, pressuring bookings and margins amid capital-intensive AI scaling. Governance and execution risks also rose with a rare co-CEO structure (Clay Magouyrk and Mike Sicilia, effective 2025-09-22), competitive threats from AI-native entrants (e.g., DualEntry vs NetSuite), and export controls (the Affiliates Rule stalling thousands of licenses worth billions), though positives include collaborations tied to OpenAI (including a reported $300 billion compute purchase over five years), planned AMD MI450 deployments in 2026, and a Stargate-linked Wisconsin data center campus over 4.50 GW—long-dated, capex-heavy projects with uncertain near-term ¹⁸ROIC.

Footnotes

¹ The performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than their original cost. Returns for periods of less than one year are not annualized. Performance results, current to the most recent month end may be obtained by visiting Qraft AI ETFs at www.qraftaietf.com/lqai. (As of 10/27/25) ² Sharpe Ratio: measures risk-adjusted return; higher values indicate better risk-adjusted performance. ³ Government shutdown: A temporary closure of U.S. federal agencies caused by the failure of Congress to pass a budget or funding bill. ⁴ Risk-off: A market sentiment in which investors move away from riskier assets (e.g., equities) toward safer ones (e.g., bonds, gold). ⁵ Inflation: A general rise in the prices of goods and services, reducing the purchasing power of money. ⁶ CPI (Consumer Price Index): A measure of the average change in prices paid by consumers for a basket of goods and services. ⁷ Duration-sensitive: Assets whose prices are highly sensitive to changes in interest rates, such as technology stocks or long-term bonds. ⁸ Cyclicals: Industries whose earnings fluctuate with the business cycle, such as autos, finance, and energy. ⁹ ADP: Automatic Data Processing, a private company that publishes monthly U.S. employment reports based on payroll data. ¹⁰ Ballast: Defensive assets in a portfolio that help stabilize performance during market volatility, such as utilities or gold. ¹¹ Policy-driven volatility: Market fluctuations caused by changes or uncertainty in government policies, including monetary, fiscal, or trade actions. ¹² Beige Book: A report published by the Federal Reserve eight times a year that summarizes current economic conditions across the U.S. ¹³ FSD: Financial Summary Data, showing key financial metrics and figures for the period. ¹⁴ EPS: Earnings per Share, a company’s net profit divided by the number of outstanding shares, used to measure profitability. ¹⁵ CapEx: Capital Expenditures, money spent on acquiring or upgrading physical assets such as buildings or equipment. ¹⁶ EBITDA: Earnings Before Interest, Taxes, Depreciation, and Amortization; a measure of operating profitability. ¹⁷ OpEx: Operating Expenses, the ongoing costs of running a business. ¹⁸ ROIC: Return on Invested Capital, a ratio that shows how efficiently a company uses its capital to generate profits.

Disclosure

For a list of the top 10 fund holdings, please visit www.qraftaietf.com/lqai. Fund holdings are subject to change.

About Qraft Technologies

Qraft Technologies is a fintech company aiming to drive growth in the asset management industry through its innovations in artificial intelligence (AI) and investing. Qraft offers a variety of AI-powered investment solutions, including a security selection engine, asset allocation engine, robo-advisory solution and an AI order-execution system. From data processing to alpha research and portfolio execution, Qraft has an established track record in developing cutting-edge AI solutions that have been adopted by over 25 financial institutions worldwide. In 2022, Qraft received a US$146 million investment from SoftBank Group, entering into a strategic partnership to accelerate AI in the asset management industry.

About LG AI Research

Launched in December 2020 as the artificial intelligence (AI) research hub of South Korea's LG Group, LG AI Research aims to lead the next epoch of artificial intelligence (AI) to realize a promising future by providing optimal research environments and leveraging state-of-the-art AI technologies. And LG AI Research developed its large-scale AI, EXAONE, a 300 billion parametric multimodal AI model, in 2021. EXAONE, which stands for “Expert AI for Everyone,” is a multi-modal large-scale AI model that stands out from its peers due to its ability to process both language and visual data. With one of the world’s largest learning data capacities, LG AI Research aims to engineer better business decisions through its state-of-the-art artificial intelligence technologies and its continuous effort on fundamental AI research. For more information, visit https://www.lgresearch.ai/.