LQAI Holdings Report for December 2025: Late‑Cycle Reset: De‑Risking

To download a PDF version of this report, click here

Fund holdings are subject to change. For a full list of fund holdings and to view the top 10 positions, please visit www.qraftaietf.com/lqai.

The performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than their original cost. Returns for periods of less than one year are not annualized. Performance results, current to the most recent month end may be obtained by visiting Qraft AI ETFs at www.qraftaietf.com/lqai.

Performance Overview

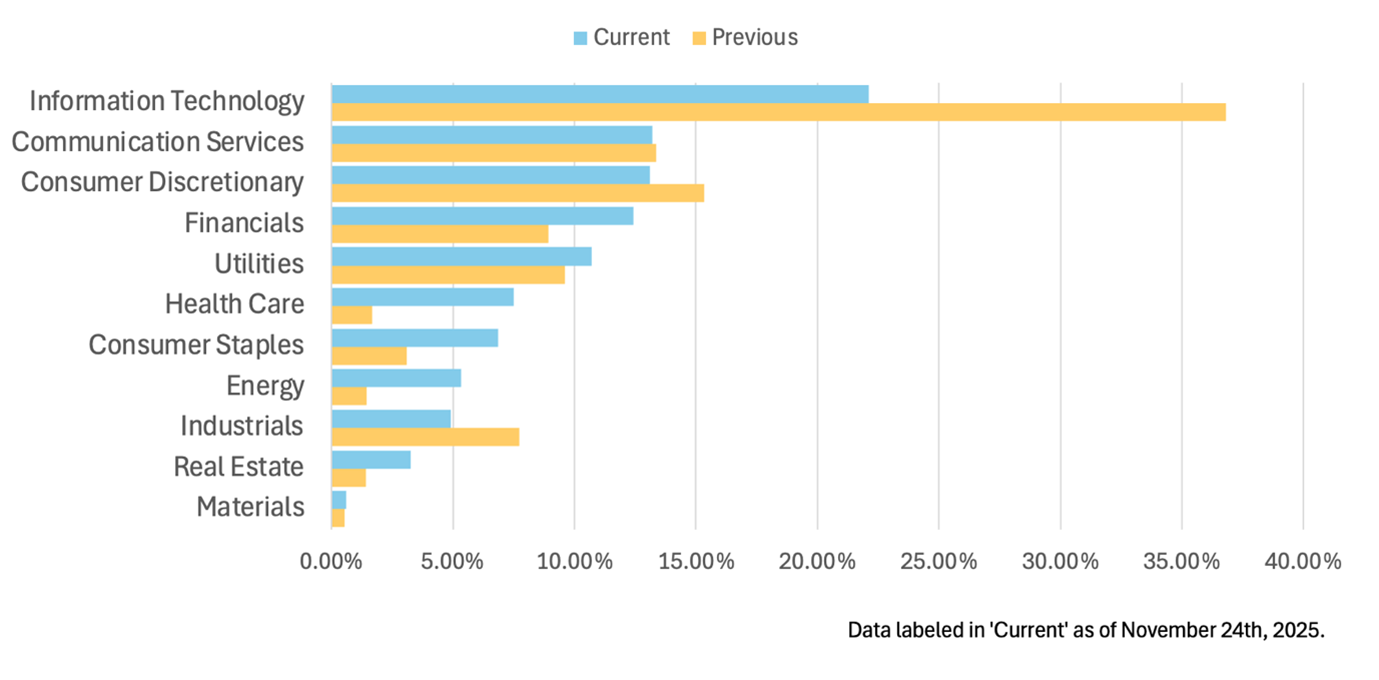

Over the review period from 2025-10-27 to 2025-11-24, the portfolio before the rebalancing delivered a weak performance, returning -8.72%, which meaningfully underperformed the S&P 500’s gain of 2.30% in October and its subsequent mid-November decline of roughly 4.00%. This drawdown was driven primarily by the portfolio’s heavy tilt toward Information Technology (38.75%), Consumer Discretionary (15.33%), and Communication Services (13.36%), with substantial single-name exposure to high-beta and AI-related growth stocks such as NVDA, AMD, TSLA, PLTR, SMCI, and MSTR, as well as cyclicals like CCL and HOOD. The macro backdrop described in the period – a cooling but still positive growth environment, “sticky” inflation near 3.00%, and a Federal Reserve that began cautiously cutting rates while explicitly worrying about stretched equity valuations – created a hostile setting for richly valued tech and AI names, particularly once the early optimism around the late-October rate cut and U.S.-China trade truce gave way to concerns over the government shutdown, surging layoffs (over 153,000 in October), and sharply weaker consumer sentiment. As the S&P 500 fell 2.40% in early November and more than 4.00% during the week of November 17–23, high-duration, sentiment-driven growth stocks underperformed broader indices, amplifying losses in a portfolio concentrated in those themes. At the same time, the relatively low allocations to defensive sectors such as Health Care (1.67%), Consumer Staples (3.09%), and Energy (1.44%), and only modest exposure to Financials and Real Estate, limited the portfolio’s ability to cushion against factor-specific drawdowns when investors rotated toward more defensive, cash-flow-resilient assets. Taken together, the portfolio before the rebalancing was positioned for continued AI and growth leadership in an environment that instead transitioned into a late-cycle phase marked by valuation compression, heightened macro uncertainty, and rising risk aversion, which explains the negative return, the low Sharpe ratio¹ of -0.07, and the decision to rebalance into the more diversified, sector-balanced portfolio after the rebalancing.

Monthly Review

Over the period from 2025-10-27 to 2025-11-24, the U.S. macroeconomy and equity market continued to move into a late‑cycle slowdown marked by sticky inflation, a gently cooling labor market, and growing reliance on Federal Reserve easing and policy headlines to sustain risk sentiment. The month opened with a strong risk‑on rally as President Trump’s late‑October tariff reduction on Chinese imports from 57.00% to 47.00% and China’s commitments on soy purchases coincided with the Fed’s 25 ²basis point cut to 3.75%-4.00% and the announced end of quantitative tightening by 2025-12-01, lifting the S&P 500 by 2.30% in October and sending the Dow to record territory. Beneath that strength, however, macro data signaled cooling rather than collapsing momentum: layoffs surged to 153,074 in October, unemployment drifted toward 4.40%, and wage growth slowed to 3.80% YoY, even as nonfarm payrolls still grew by 119,000 and services sectors such as health care and food services added jobs. Inflation remained stuck near 2.80%-3.00% YoY on both ³CPI and ⁴PCE, reflecting services and tariff‑related cost pressures and reinforcing a “sticky disinflation” backdrop that left markets continually repricing the odds of a December cut between roughly 49.00% and 71.00%. The 43‑day government shutdown became a key macro shock—cutting an estimated $14.00 billion from activity and subtracting roughly 1.50 percentage points from GDP growth—while disruptions to aviation, federal data releases, and food assistance for 42 million SNAP beneficiaries pulled the ⁵University of Michigan sentiment index down to 50.30 and underscored the vulnerability of lower‑income households. Equity markets mirrored these cross‑currents: after the October gains, the S&P 500 fell roughly 2.40% in early November and ultimately declined more than 4.00% for the month, led by corrections in richly valued technology and AI names that left the Nasdaq with its worst weekly drop since April 2025, even as strong single‑name earnings from companies like Nvidia and Amazon produced sharp but narrow rallies. The mid‑November resolution of the shutdown on November 12 and passage of a funding bill, which restored federal operations and unlocked around $50.00 billion in spending, sparked a relief bounce that lifted the S&P 500 by 1.39% and the Nasdaq by 2.27% on November 10 and later pushed the Dow up 493.15 points (1.08%) on November 23 as expectations for a December Fed cut rose to 71.00%. Yet gains remained tenuous as investors weighed weaker labor data, weekly private job losses of over 11,250, and slowing global demand against improved fiscal clarity, while geopolitical developments, tariff adjustments on Swiss and Brazilian imports, and sharp moves in gold (briefly above $4,200.00 per ounce) and Brent crude reinforced a defensive bid and highlighted the sensitivity of inflation and margins to external shocks.

Looking ahead to the next month, the U.S. economy is expected to continue expanding at a modest, late‑cycle pace but with rising downside risks and persistent cross‑currents. Growth is likely to slow from Q2’s 3.80% annualized rate toward a more moderate, consumer‑led expansion, yet headline layoffs at 153,074 in October, unemployment near 4.40%, and consumer sentiment at 50.30 point to fragile household confidence and thinner savings buffers, particularly for low‑ and middle‑income cohorts. Inflation is projected to hover around 2.80%-3.00% YoY on CPI and PCE as services, wages at 3.80% YoY, and tariff‑related input costs counteract goods disinflation, supporting the “sticky disinflation” narrative and limiting how aggressive the Fed can be with further easing. Markets head into December focused on whether the Federal Reserve delivers another 25 basis point cut after already moving to 3.75%-4.00% and signaling an end to quantitative tightening by 2025-12-01; with cut probabilities oscillating between about 49.00% and 71.00%, policy guidance is likely to dominate day‑to‑day risk appetite more than any clear improvement in underlying fundamentals. The resolution of the 43‑day shutdown and release of roughly $50.00 billion in pent‑up federal spending should help stabilize activity at the margin, but the estimated 1.50 percentage point GDP drag for the year, combined with ongoing weekly job losses above 11,250, leaves the macro backdrop fragile and leaves little cushion against adverse shocks. Equity markets are therefore likely to remain volatile and unevenly led: after the S&P 500’s 2.30% October gain and November’s more than 4.00% decline, along with the Nasdaq’s worst week since April 2025, richly valued technology and AI segments appear particularly vulnerable to further de‑rating as investors reassess earnings durability amid slowing growth, persistent inflation pressures, and continued geopolitical and trade risks in energy and commodities. In this environment, the central scenario is one of moderate growth and contained but stubborn inflation, with bouts of risk‑on driven by policy headlines, but with a higher probability of setbacks than in earlier stages of the cycle.

The portfolio has been rebalanced to reflect this late‑cycle, risk‑aware assessment by reducing exposure to high‑beta growth, broadening diversification across defensives and resilient cyclicals, and moderately increasing allocations to sectors positioned to benefit from stable or gently easing rates. Information Technology exposure has been scaled back from 38.75% to 22.09%, lowering single‑name risk in high‑valuation AI and semiconductor leaders (through smaller positions in NVDA, AMD, AVGO, and related holdings) while retaining core stakes in GOOGL, MSFT, AAPL, NVDA, and AVGO to participate in ongoing structural growth if rate cuts support valuations. At the same time, the portfolio tilts toward quality defensives that historically hold up better when labor markets soften and sentiment weakens: Health Care rises from 1.67% to 7.51% via additions such as MRK, PFE, LLY, REGN, GEHC, MCK, BIIB, CAH, EW, and JNJ, and Consumer Staples increase from 3.09% to 6.87% through higher weights in WMT, KHC, GIS, KDP, KO, PEP, and KVUE, aiming to support earnings if lower‑income consumers pull back on discretionary spending. Utilities are modestly increased from 9.62% to 10.70% across names including PPL, FE, PCG, CNP, XEL, EXC, D, SRE, AEP, and ETR, reflecting the view that a measured Fed easing cycle and the end of QT should aid rate‑sensitive, income‑oriented sectors as long as inflation stays near 3.00%. Financials rise from 7.30% to 11.95% via higher allocations to large, diversified and regional institutions (BRK.B, HBAN, TFC, USB, FITB, BAC, NDAQ, CB, WM, BR), positioned to benefit from a modestly steepening curve and somewhat easier credit conditions if the Fed cuts while the economy avoids a deep contraction. Exposure to Energy increases from 1.44% to 5.32% through additions such as XOM, SLB, BKR, OXY, and VLO, acknowledging the ongoing geopolitical and supply‑driven support for oil prices and the sector’s inflation‑hedging characteristics, while Real Estate rises from 1.43% to 3.25% (VICI, WELL, IRM, PLD, O, VTR) to capture potential upside from lower long‑term yields without overcommitting to a single macro outcome. Overall, the shift from a concentrated, tech‑heavy profile to a more balanced mix across defensives, selective cyclicals, and high‑quality growth aligns the portfolio with an environment where capital preservation, earnings resilience, and flexibility take precedence over maximizing participation in short‑lived risk‑on rallies.

Portfolio Overview

Top Holdings – GOOGL [5.73% of portfolio]

Alphabet Inc. (GOOGL) is operating in a favorable environment, supported by strong AI, cloud, and digital media momentum, and the LQAI portfolio has been rebalanced to keep Alphabet as a top‑three holding with an increased weight even as overall Information Technology exposure was reduced, reflecting a rotation from more speculative AI names toward a scalable, platform‑level beneficiary with balance‑sheet strength and diversified AI monetization. LQAI’s higher conviction stems from Alphabet’s large‑scale AI and cloud initiatives—such as the launch and direct integration of Gemini 3 into Search, multi‑billion‑dollar data‑center expansion in multiple countries, the growing Waymo robotaxi footprint, and strategic cloud deals like the Australian Department of Defence agreement—which collectively position the firm as a core infrastructure and application layer in the AI ecosystem and support expectations of durable, compounding value. Alphabet’s strategy is further strengthened by its alignment of growth with sustainability and energy security, including a 25‑year nuclear power purchase agreement with NextEra to restart the Duane Arnold plant and a record carbon‑removal contract with Mombak in Brazil, which mitigates execution, regulatory, and ESG risk around its AI build‑out and differentiates it from peers that are more exposed to grid and environmental constraints; this underpins the portfolio’s decision to emphasize higher‑quality Communication Services exposure with Alphabet as the anchor. Institutional validation and evolving legal‑regulatory dynamics also reinforce confidence: Berkshire Hathaway’s multi‑billion‑dollar stake is viewed as a strong endorsement of Alphabet’s fundamentals and long‑term AI and digital advertising prospects, while mixed but generally manageable regulatory outcomes—DOJ clearance for the Wiz cybersecurity acquisition, a favorable U.S. Supreme Court patent ruling, and the closure of an Italian antitrust probe—temper breakup fears despite ongoing ad‑tech scrutiny. Overall, the portfolio views Alphabet’s fundamental profile—global AI and cloud infrastructure scale, diversified revenue streams including Search, YouTube, cloud, and emerging businesses like Waymo and Wiz, strong capital resources, and active ESG and regulatory risk management—as supportive of continued solid financial performance and a constructive long‑term outlook, justifying its status as a core, overweight position in LQAI.

Top Holdings – NVDA [5.02% of portfolio]

Nvidia’s outlook remains strongly positive amid extraordinary AI infrastructure demand, and the LQAI portfolio has been rebalanced to keep Nvidia as a top‑three, conviction holding at 5.01% while materially reducing overall Information Technology exposure from 38.75% to 22.09% and reallocating toward defensives such as Health Care, Consumer Staples, and Energy to temper volatility risk. Nvidia is viewed as a structural winner and the de facto backbone of the AI economy, supported by fundamentals that include massive AI chip bookings, “very strong” demand and likely supply shortages for its next‑generation Blackwell products, and leading roles in mega‑scale deployments spanning hyperscalers, government supercomputers, and large AI infrastructure programs. The firm’s ecosystem strength and financial performance are reinforced by multi‑billion‑dollar processor and data‑center deals tied to Microsoft and other cloud providers, an expanding installed base across cloud, enterprise, and automotive (including a $3.00 billion joint venture with Hyundai), and significant strategic commitments to AI leaders such as Anthropic, which together indicate durable revenue growth drivers and high returns on invested capital. While some semiconductor and AI‑adjacent holdings have been reduced or removed to cut higher‑beta exposure and overall semiconductor weight, capital has been consolidated into Nvidia alongside select platform names like Alphabet, Amazon, Microsoft, and Palantir, reflecting the belief that AI infrastructure spending—projected to reach trillions of dollars by 2030—will disproportionately accrue to Nvidia’s platform and ecosystem. Geopolitical and regulatory risks, including export restrictions to China, China’s push for domestic AI chips, antitrust scrutiny, and evolving AI governance proposals, are recognized as material headwinds that could affect segment growth and contribute to pronounced volatility, but recent partial offsets, such as approvals for significant Blackwell shipments to the Middle East and licensing of certain chips to China under a “managed access” regime, support the view that these challenges are manageable rather than thesis‑breaking. Overall, the portfolio’s positioning—reduced sector ⁶beta, higher exposure to non‑tech stabilizers, and a still‑elevated allocation to Nvidia—expresses continued confidence in Nvidia’s fundamental strength, financial resilience, and central role in the long‑term AI build‑out, even as macro, regulatory, and sentiment risks are actively hedged.

Top Holdings – AMZN [4.72% of portfolio]

The LQAI portfolio has been significantly rebalanced to make Amazon.com Inc. (AMZN) a top‑three holding, reflecting conviction that Amazon sits at the center of a multi‑year AI and infrastructure cycle and offers an efficient way to gain exposure to AI, cloud, and value‑retail themes in a volatile macro and regulatory environment. The portfolio now emphasizes Amazon’s core AI and cloud role—underscored by its large multi‑year partnership with OpenAI, expansion of AWS data centers, Trainium‑based infrastructure, and its Project Rainier initiative with over 1 million Trainium2 AI chips—viewing AWS not as a cyclical commodity business but as a long‑duration growth platform, and shifting exposure away from narrower semiconductor and IT bets toward diversified AI monetization across AWS, advertising, and AI‑enhanced retail. Fundamentals are seen as strong: Amazon is reallocating capital and labor from bureaucracy to high‑return areas such as AI, automation, and logistics, cutting up to 30,000 corporate jobs to improve structural efficiency while still hiring 250,000 seasonal workers and expanding low‑cost international offerings like Amazon Bazaar, which supports both growth and margin resilience and justifies concentrating Consumer Discretionary exposure in high‑quality platforms like Amazon. Its balance sheet and market access also look robust, with a heavily oversubscribed $15.00 billion bond issue at relatively tight spreads signaling that fixed‑income investors regard Amazon as a low‑risk compounder capable of funding very large future capex for AI and cloud infrastructure. Although the firm faces rising regulatory and legal scrutiny—particularly in the EU under the DMA and DSA, and as a potential “gatekeeper” platform—the portfolio has responded by trimming overall IT beta and increasing allocations to more defensive sectors while still elevating Amazon, judging that the regulatory costs remain manageable relative to its strategic upside. Overall, the outlook for Amazon in the portfolio is positive: it is viewed as a structural winner in global AI and cloud infrastructure with improving operating efficiency, solid financing capacity, and resilient retail fundamentals, warranting a larger, core position despite a more challenging policy backdrop.

Notable Changes – WMT (Upgrades) [2.33% of portfolio]

Walmart Inc. (WMT) has been upgraded in the LQAI portfolio from a small satellite position (0.14%) to a core holding (2.33%), making it one of the largest Consumer Staples positions and central to a shift toward more defensive, cash‑generative staples and value retailers as consumer sentiment weakens and inflation in essentials remains elevated. This higher weight is driven by Walmart’s strong fundamentals and financial performance, including a recent earnings beat with adjusted EPS and revenue above expectations, U.S. comparable sales growth meaningfully ahead of forecasts, and an upgraded annual sales growth outlook, achieved despite macro headwinds such as government shutdown risk, tariff volatility, and weak consumer sentiment; together with share gains from weaker competitors, this supports a conviction stance. Strategically, Walmart’s positioning in e‑commerce and AI—highlighted by plans for AI‑powered “super agents,” a goal for e‑commerce to reach 50% of total sales within five years, and continued generative AI investment in supply chain and customer engagement—along with initiatives like a Nasdaq relisting and international expansion (including its first South Africa store), recasts it as a scalable platform company rather than a slow‑growth brick‑and‑mortar chain, and allows the portfolio to rotate out of more speculative Technology names into Walmart as a lower‑risk way to gain AI and online growth exposure. Walmart’s pricing strategy and ecosystem expansion further strengthen its outlook: aggressive value messaging (e.g., sharply lower‑priced holiday meal baskets) enhances its appeal to budget‑conscious households amid elevated food inflation, while health‑care/pharmacy initiatives such as the Eli Lilly Zepbound partnership tap into a large, higher‑margin obesity‑treatment market and deepen customer engagement. Although leadership changes, logistics risks, and tariff‑related uncertainties introduce some operational noise, the continuation of a technology‑heavy strategy, upgraded guidance when peers are struggling, and resilience to policy issues around SNAP and tariffs underpin a constructive outlook, and LQAI therefore treats Walmart as a key long‑term beneficiary of the “value and essentials” trade and an upgraded core holding in the current rebalance.

Notable Changes – BRK.B (Upgrades) [2.18% of portfolio]

Berkshire Hathaway Inc. (BRK.B) is viewed as being in a transitionary but strengthening position, prompting its portfolio weight in LQAI to be raised from a negligible level to 2.18% and helping increase overall Financials exposure from 7.30% to 11.95%, while Information Technology exposure is trimmed, making Berkshire a core “all‑weather” financial/industrial compounder and a central anchor between large‑cap tech growth and more cyclical financial and energy holdings. The upgrade is underpinned by strong fundamentals and financial performance: Berkshire’s latest quarter delivered a 34% increase in operating profit to $13.49 billion, a 17% rise in net income to $30.80 billion, and a sharp improvement in insurance underwriting earnings from $0.75 billion to $2.37 billion, alongside record cash reserves of about $381.70 billion and an equity portfolio of roughly $283.20 billion, giving it exceptional capital‑deployment optionality as monetary policy becomes more accommodative. While investors have been concerned about sustained net stock selling and a pause in buybacks, LQAI sees asymmetric upside if capital deployment improves even modestly under Greg Abel’s incoming leadership. The portfolio also leans into Berkshire’s evolving investment strategy, notably its rotation within technology via builds in Alphabet and trims in Apple and other mega‑caps, which the portfolio mirrors with a large direct GOOGL position and other selective tech holdings; Berkshire thus provides second‑order exposure to durable, cash‑rich platforms while allowing the portfolio’s aggregate tech weight to be reduced. Additionally, favorable insurance‑market dynamics—particularly Berkshire Hathaway Specialty Insurance’s focus on structurally growing parametric coverage and participation in higher‑margin, data‑driven segments—combine with clear succession and continued owner‑operator oversight (Buffett remaining a major shareholder and endorsing Abel) to support a constructive outlook. Overall, the upgraded BRK.B allocation reflects conviction that Berkshire’s strong balance sheet, diversified earnings base, advantaged insurance franchises, and disciplined capital allocation in a supportive macro backdrop should enable it to compound intrinsic value and be a relative beneficiary of both sector‑wide financials tailwinds and company‑specific catalysts.

Notable Changes – HOOD (Downgrades) [0.17% of portfolio]

Robinhood Markets Inc. (HOOD) has been sharply downgraded in the rebalanced LQAI portfolio to a small satellite position, as its recent strength is seen as increasingly driven by speculative, high‑beta crypto and prediction‑market activity rather than durable, risk‑adjusted fundamentals. While Q3 2025 fundamentals appear strong on the surface—with revenue doubling year‑over‑year to $1.27 billion and net income reaching $556 million, largely propelled by a 300% surge in cryptocurrency transaction revenue and a doubling of total transaction‑based revenue to $730 million—this mix heightens earnings cyclicality and uncertainty. At the same time, management has raised 2025 adjusted operating expense guidance to about $2.28 billion to fund new initiatives such as Prediction Markets and Robinhood Ventures, increasing fixed costs and operating leverage to market conditions. HOOD’s platform has grown to 27.10 million funded customers with $343.00 billion in assets, but the quality of activity is deteriorating as more trading resembles gambling, leaving the business model highly sensitive to shifts in speculative sentiment and potential regulatory scrutiny, especially in a macro environment of rising unemployment, elevated volatility, and growing concern over bubbles in risk assets. The firm’s strategic push into prediction markets and new trading products may deepen engagement and diversify revenue, yet it further binds the company to controversial, quasi‑gambling lines of business just as regulators intensify their focus on consumer protection and systemic risk. Given these dynamics, the LQAI portfolio has rotated toward higher‑quality, more traditional Financials and defensive sectors, leaving HOOD as a small optionality play whose outlook is characterized by strong headline financial performance but an increasingly fragile, sentiment‑driven earnings base and elevated regulatory and business‑model risk.

Notable Changes – INTC (Downgrades) [0.15% of portfolio]

Intel Corporation (INTC) is now viewed as one of the weakest names in the semiconductor complex within the LQAI portfolio, which has been sharply downgraded from a core to a small, tactical satellite holding as capital is redirected to stronger AI beneficiaries such as Nvidia, Broadcom, and AMD and to higher-quality compounders in other sectors. Fundamentally, Intel’s outlook is challenged: despite lagging peers in AI product competitiveness and data center growth, it carries a significantly elevated valuation multiple and is undergoing a major restructuring, including the layoff of about 25,000 employees, underscoring margin pressure, execution risk, and cultural disruption. Competitive and regulatory pressures are eroding its medium‑term prospects, as Intel continues to lose share in server CPU and AI data center markets to AMD and Nvidia while facing regulatory exclusion from China’s state-funded AI data centers, capping its addressable market just as it had been emphasizing Chinese CPU and AI opportunities. Strategic and execution risks around its AI pivot—leadership changes in key technical roles, a potential acquisition of SambaNova, and heavy investment in contract manufacturing and AI GPU roadmaps—add integration and capital-allocation uncertainty in an already capex-intensive environment and do not yet offer clear evidence of closing the gap with peers. Taken together, these factors have led the portfolio manager to concentrate semiconductor risk in companies with stronger earnings momentum and clearer AI leadership, while retaining only a small “option value” position in Intel in case its turnaround, AI initiatives, and foundry strategy eventually succeed, but with a cautious and uncertain outlook prevailing for now.

Footnotes ¹ Sharpe Ratio measures risk-adjusted return by dividing excess return over the risk-free rate by volatility. ² Basis Point (bp) is a unit used to measure interest rate changes, where 1 bp equals 0.01%. ³ CPI (Consumer Price Index) measures inflation based on changes in prices of goods and services purchased by consumers. ⁴ PCE (Personal Consumption Expenditures Price Index) is the Federal Reserve’s preferred inflation indicator that tracks changes in consumer spending prices. ⁵ The University of Michigan Consumer Sentiment Index measures consumer confidence in the economy based on survey data. ⁶ Beta measures a stock’s sensitivity to overall market movements, where a value above 1 indicates higher volatility than the market.